With mortgage rates deep in the cellar again, homeowners are scrambling to refinance and cut their monthly payments, often by hundreds of dollars.

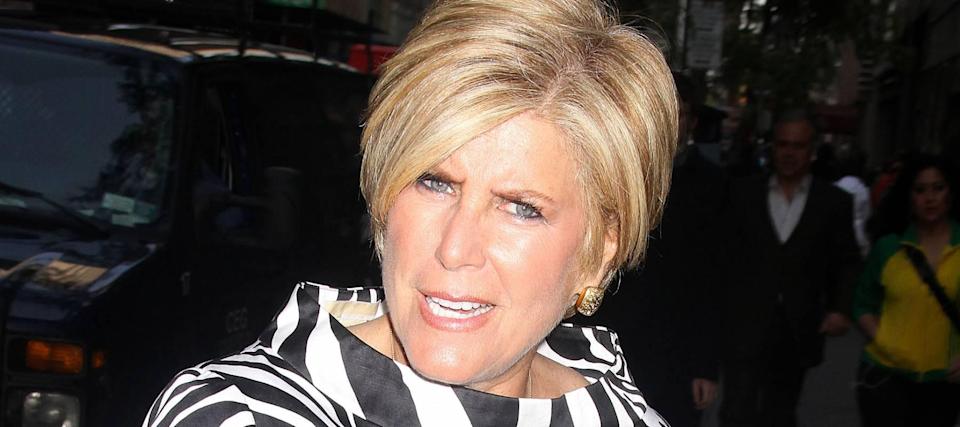

If you’re thinking of joining the latest rush to refi, personal finance author and TV personality Suze Orman wants you to pause and take a deep breath — so you won’t blow it.

“It makes me so crazy how most homeowners make a huge mistake when they refinance,” she says.

It’s a blunder Orman says can easily saddle you with much higher interest costs, even if you manage to land a mortgage rate your friends will envy.

‘So very wrong’

The average 30-year fixed mortgage rate has sat below 3% since early July, according to mortgage giant Freddie Mac, and the return of rock-bottom rates has sparked a new mini-boom in refinancing.

The savings can be considerable: Almost half (47%) of homeowners who refinanced over the past year of ultra-low rates are now saving at least $300 a month, a recent Zillow survey found.

Orman is concerned that many enthusiastic refinancers make a costly mistake: automatically reaching for another 30-year mortgage, even if they’ve been paying down their existing 30-year loan for years.

“This is so very wrong,” the personal finance guru writes in her blog.

Suppose you’ve been paying down your original loan for 14 years, then you take out a new 30-year mortgage. “Sure, the new mortgage is at a lower interest rate, but you just extended your mortgage payment on this home to 44 years!” she says.

When a 30-year refinance might make sense

The 30-year fixed-rate mortgage is America’s most popular home loan, so it might naturally be the go-to for homeowners who want to trade in their existing mortgages for a better deal.

And it’s the obvious choice if your mortgage is fairly new. Early last year, 30-year mortgages were averaging around 3.75%, Freddie Mac says — almost 1 full percentage point lower than today’s typical rate of 2.86%.

But, like many experts, Orman generally recommends refinancing to a new loan with a shorter term.

“My rule of refinancing is that you are to never extend your total payback period past 30 years,” she says in the blog.

Let’s say you are indeed still holding on to a 30-year loan you took 14 years ago during September 2007.

Back then, rates were averaging a stiff 6.40%. (Seriously, you should have refinanced before now.) Say your mortgage was originally in the amount of $250,000; you’d now have a balance left of about $188,000.

Why to consider refinancing into a shorter-term loan

If you were to refinance that $188,000 balance to a new 30-year mortgage at today’s average rate of 2.86%, and stay with the loan for the entire term, the lifetime interest would top $92,000.

You could choose to do a 15-year refinance instead. Fifteen-year mortgages have lower interest rates than 30-year loans: The average for a 15-year is currently just 2.12%, not far from the recent all-time low of 2.10%.

With a $188,000 15-year mortgage at 2.12%, you’d pay interest of about $31,600 over the life of the loan. That’s $60,400 less than the 30-year refinance.

But many refinancers don’t opt for a 15-year loan because they don’t think they can afford the higher payments:

-

The monthly payment (principal plus interest) on a 30-year refi in the amount of $188,000 at 2.86% is $778.

-

The monthly payment (principal plus interest) on a 15-year refi in the amount of $188,000 at 2.12% is $1,220.

But Orman says in recent years 15-year mortgage rates have been so low “that you may be able to refinance your remaining balance and end up with a payment that is not much different than what you were paying on your 30-year.”

And in our example, it’s true:

-

The monthly payment (principal plus interest) on the original 30-year mortgage in the amount of $250,000 at 6.4% was $1,563. The new 15-year loan costs $343 less per month.

30-year refi or 25-year? How to choose

Suze Orman says don’t forget about closing costs when doing your refinance math.

Whichever type of mortgage you settle on for your refinance, you want to feel certain you’re going to stay in the home a few years.

“There is no such thing as a free refinance,” Orman says. “You will either pay closing costs — which can be a few percentage points of your loan cost — or a higher interest rate.”

Refi closing costs average about $3,400, according to the most recent data from the research firm ClosingCorp. You won’t want to move until after the savings from that new, lower mortgage rate of yours have paid off the closing costs and then some.

If you believe you’re in the house for the long haul, refinancing into a 15-year mortgage can be the wise choice — if you can handle the stiffer payments. Your interest rate will be lower and you’ll pay tens of thousands less in interest over time.

Going with another 30-year mortgage and its lower monthly costs can be the smarter move if you’re not likely to stay in the house long term. If you may be leaving within a few years, what does it matter if you have a 30- or a 15-year loan?

Before you settle on any loan, shop around. Don’t assume the very first lender you hit up will offer you the lowest rate possible.

Gather mortgage offers from several lenders to find the best rate available in your area and for a person with your credit score. If you’re not sure what yours is, it’s easy today to check your credit score for free.

Then, put your comparison shopping skills to use again when you get your renewal notice for your homeowners insurance. You can easily get multiple home insurance quotes and compare rates, to find what works best for you.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.