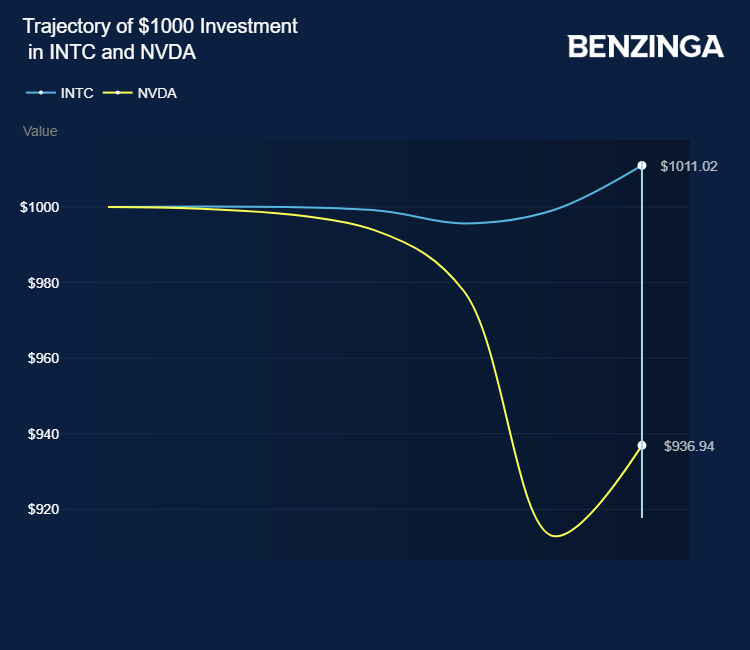

U.S. Chips Act beneficiary Intel Corp (NASDAQ:INTC) had a positive week till Thursday, while Nvidia Corp (NASDAQ:NVDA) and Advanced Micro Devices, Inc (NASDAQ:AMD) lost 5% and 15%, respectively.

On Wednesday, the broader semiconductor sector lost over $500 billion in stock market value as reports indicated that the U.S. is intensifying its advanced semiconductor embargo against China.

This was followed by Presidential candidate Donald Trump attacking global contract chipmaker Taiwan Semiconductor Manufacturing Co (NYSE:TSM). Investors leveraged the opportunity for profit booking.

Now, let us take a look at the positive pointers for Intel. Last week, reports indicated Intel CTO Greg Lavender targeting $1 billion in software and developer cloud subscription revenue, possibly reaching this before 2027.

In 2021, Intel generated over $100 million in software revenue after CEO Pat Gelsinger recruited Lavender from VMware.

Lavender expects Intel’s upcoming Gaudi 3 chip to help it secure a strong position in the AI chip market.

Nvidia leads the AI accelerator market with a share of 70% – 95%, as per Mizuho Securities. Intel expects the Gaudi 3 chip to generate $500 million in revenue in late 2024. Morgan Stanley expects the total Gaudi shipment in 2025 to generate $2 billion—$3 billion in revenue for Intel.

Intel and AMD are competing for dominance in the AI PC market.

Intel aims to ship chips for over 100 million AI PCs by 2025, including over 40 million in 2024.

In the second quarter of 2024, DNB Asset Management, which manages approximately $88 billion in assets, made notable adjustments to its U.S.-traded big tech holdings. They reduced their stake in Nvidia and more than doubled its investment in Intel.

In the second quarter of 2024, Intel processors accounted for 64% of all x86 CPU tests, while AMD processors made up 33%, as per Statista. Focusing on laptop CPUs, Intel dominated with 75% of benchmark test results for the same period.

Intel trades at a forward P/E multiple of 32.57 versus AMD at 45.46 and Nvidia at 46.3, as it lacks the AI chip moat due to a decade of underinvestment leading to a technology gap as per Forbes.

Intel’s Price/Sales of 2.67 is a stark contrast to AMD at 11.15 and Nvidia at 37.85. Intel stock lost over 2% in the last three months, above 24% in the last 6 months.

Intel has a consensus price target of $39.82 based on 33 analysts’ ratings. The most recent analyst rating was on July 16, when Cantor Fitzgerald analyst C J Muse reiterated Intel with a Neutral rating and a $40 price target.

Analysts noted that Intel is experiencing a slow recovery in its PC and data center segments. Customers are delaying server demand recovery, prioritizing AI infrastructure over traditional servers.

Price Action: INTC shares are down 5.10% at $33.09 at the last check on Friday.

Photo via Shutterstock

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article What’s Going On With Intel Stock On Friday? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Source: finance.yahoo.com