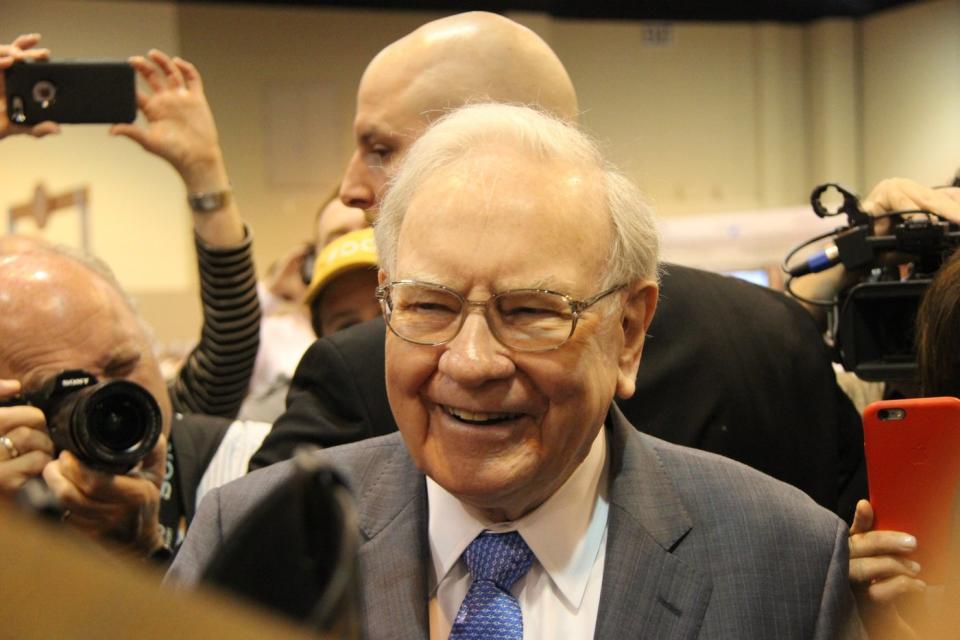

Warren Buffett led the Berkshire Hathaway investment company to market-beating returns every year (on average) since 1965.

When he’s considering buying a stake in a company, Buffett likes to see a long track record of success, solid growth potential, and a strong management team. He especially likes companies that return money to shareholders through dividends and stock buybacks, because these tools can accelerate the effects of compound growth on an investment over the long term.

Buying a stock solely for the company’s artificial intelligence (AI) capabilities would be out of character for Buffett (and Berkshire). But the conglomerate happens to own stakes in a number of companies that are developing aspects of the technology on top of their core businesses, and just four of them account for 55.1% of its $370 billion portfolio of publicly listed stocks.

1. Snowflake: 0.3% of Berkshire Hathaway’s portfolio

Though it’s just a tiny piece of the portfolio, Snowflake (NYSE: SNOW) was an unusual choice for Berkshire Hathaway. It purchased the stock during its initial public offering in 2020, and while Snowflake is still higher than its $120 a share IPO price, it has been below where it closed its first trading day for almost a year, it isn’t turning a profit, and it doesn’t pay a dividend. However, Snowflake is an innovative cloud computing enterprise with a fast-growing presence in AI.

Snowflake’s flagship Data Cloud product helps organizations aggregate their data onto one platform, no matter which cloud infrastructure providers they use. Its Snowpark platform is a similar innovation that helps bring software developers together to collaborate securely in one place, no matter what programming language they prefer. And the company recently launched Cortex — a collection of AI-focused tools designed to complement those cloud services.

One such tool is Document AI, which allows businesses to extract valuable insights from unstructured data of the types commonly found in contracts or invoices. Cortex also features Snowflake Copilot, a generative AI virtual assistant capable of creating computer code from text-based prompts. That could significantly accelerate software development projects for Snowflake’s cloud customers.

2. Amazon: 0.4% of Berkshire Hathaway’s portfolio

Berkshire owned Amazon (NASDAQ: AMZN) stock since 2019, well before the generative AI craze began. Buffett has often expressed regret for not buying it sooner, but Amazon is quickly becoming one of the most dominant companies in the AI industry, and the technology could drive substantial growth for it in the future.

Amazon is developing AI in every segment of its business. Its cloud computing arm, Amazon Web Services (AWS) is getting the most attention from investors because it offers business customers a comprehensive portfolio of large language models to help them build AI applications. Plus, in a bid to compete with Nvidia‘s industry-leading hardware, Amazon has developed its own data center chips designed to process AI workloads.

It also offers generative AI tools to businesses on its e-commerce platform to help them create more engaging product images, descriptions, and ads. Plus, AI is responsible for delivering more accurate product recommendations to customers based on their search habits and purchasing patterns.

Amazon could prove to be one of Berkshire’s best AI bets over the long term.

3. Coca-Cola: 6.4% of Berkshire Hathaway’s portfolio

Soda and beverage giant Coca-Cola (NYSE: KO) isn’t a company one would normally associate with AI. But it’s dabbling in the technology in a few different ways, and even appointed a global head of generative AI last year to spearhead its strategy.

Coca-Cola released a drink in 2023 called Y3000 that was formulated using AI. The company collected inputs from consumers to determine their visions for the future, then had an AI use that data to predict what Coca-Cola might taste like in the year 3000. Plus, the soda giant is using AI to curate marketing campaigns. It launched “Create Real Magic” at Christmas time — featuring a generative AI model powered by OpenAI’s GPT-4 technology — to allow consumers to create Christmas-themed Coca-Cola imagery.

Initiatives like Y3000 and Create Real Magic are designed to engage consumers on deeper levels than traditional media-based advertising, which increases brand awareness and (theoretically) drives more sales.

Berkshire owned Coca-Cola stock since 1988, and its $23.6 billion stake is the portfolio’s fourth-largest holding.

4. Apple: 48% of Berkshire Hathaway’s portfolio

Berkshire’s largest holding is Apple (NASDAQ: AAPL), which also happens to be the second-most valuable company in the world (narrowly being beaten by Microsoft. Apple was founded in 1976, but most of its success has come since 2007, following the launch of its first iPhone. That led to the introduction of several billion-dollar hardware platforms, including the Apple Watch and AirPods wireless headphones.

But Apple’s latest smartphone, the iPhone 15 Pro, set the stage for its AI-powered future. It’s fitted with the Apple-designed A17 Pro chip, which is capable of processing AI workloads more efficiently on-device, rather than relying on sending such tasks to external data centers. That means features like autocorrect and the Siri voice assistant deliver results to users much faster, but what’s coming makes the new hardware even more appealing.

Apple is working on its own large language models, and that effort could culminate in an AI application that is intended to compete with ChatGPT. That has the potential to change the way consumers use the iPhone, because a powerful AI assistant of that caliber would bring automation to everything from emails to messages to appointment setting. The ability to quickly create and edit images and videos would also transform the way Apple users share content with their friends, families, and online.

Apple is positioned well in the AI race because it has an installed base of over 2 billion active devices worldwide (iPhones, iPads, Mac computers, and others). That means any AI application it releases is likely to immediately see widespread adoption, potentially even leapfrogging today’s leaders like ChatGPT. AI might not be the reason Berkshire first bought Apple stock, but the technology could drive substantial long-term gains for the company.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Microsoft, Nvidia, ServiceNow, and Snowflake. The Motley Fool has a disclosure policy.

55.1% of Warren Buffett’s $370 Billion Stock Portfolio Is Invested in 4 Artificial Intelligence (AI) Stocks was originally published by The Motley Fool

Source: finance.yahoo.com