Over the past year, Nvidia (NASDAQ: NVDA) has been the talk of the town and one of the stock market’s best-performing large companies. The company designs the kind of advanced graphics processing unit (GPU) technology needed for artificial intelligence (AI). As a result, the GPU leader’s revenue and earnings have been skyrocketing.

Sales surged 206% year over year in the company’s third quarter, and non-GAAP (adjusted) earnings rose 593%. With guidance for sales growth of roughly 231% in the fourth quarter, Nvidia expects the incredible momentum to continue in the near term.

However, the combination of the company’s explosive stock gains and the historically cyclical nature of the semiconductor industry suggests that Nvidia may be too hot for some investors to handle. Additionally, the company could see some uneven performance due to bans on advanced chip sales to China and upcoming performance comparisons to recent periods that likely benefited from Chinese customers frontloading GPU orders to get ahead of regulations.

Over the long term, there’s still a good chance that Nvidia will deliver strong returns. But another “Magnificent Seven” AI stock is offering a risk-reward profile that’s probably a better fit for many investors.

If you’ve got your financial bases covered and are looking to invest $1,000 or more into a sturdy AI leader, read on to see why Microsoft (NASDAQ: MSFT) stands out as the smartest buy right now.

Microsoft is on top of the AI world

Microsoft recently unseated Apple as the world’s largest company as measured by market capitalization, although the two are going back and forth this month over who is on top (Apple currently has it). I think there’s a very good chance that the software giant will regain and and then retain the title for much of the next decade. For investors seeking AI growth stocks backed by dependable businesses and strong competitive moats, Microsoft continues to be a great play.

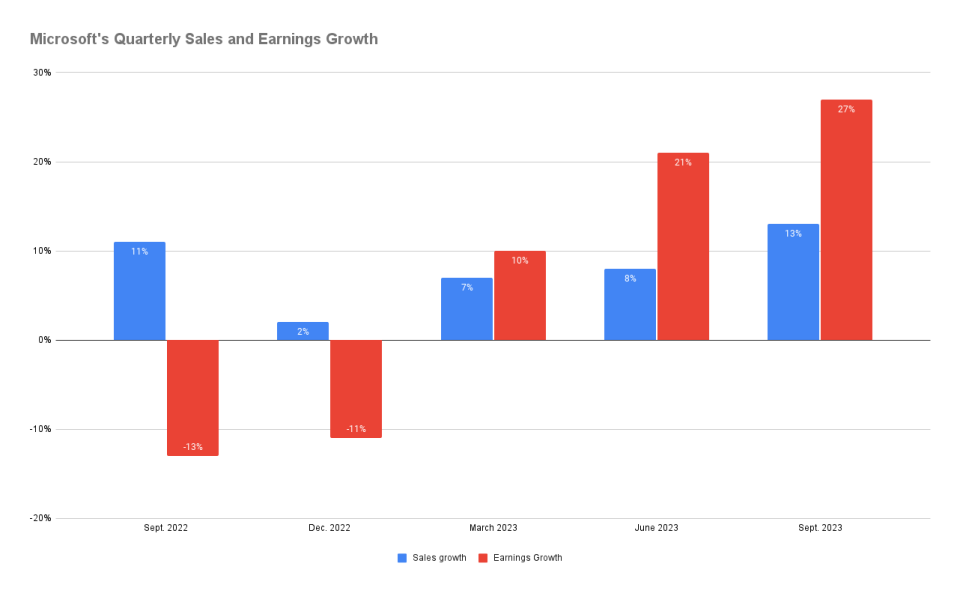

Even as it faced macroeconomic headwinds and one-time tax liabilities over the last year, Microsoft continued to post sales growth and strong profits. Now positive performance momentum is accelerating again.

Microsoft grew its revenue 13% year over year to reach $56.5 billion in its September-ended quarter. The company’s operating income rose 25% year over year to hit $26.9 billion, and its net income jumped 27% to hit $22.3 billion.

Microsoft’s Azure cloud infrastructure platform is at the heart of its surging profitability. AI developers are turning to the company’s cloud offering to develop, launch, and scale their applications, and this tailwind is still just starting.

Microsoft is integrating AI into its operating systems and productivity software, and the company’s Copilot software also makes it a frontrunner in the potentially explosive AI personal assistant space. Microsoft is even designing its own AI chips. Virtually every aspect of the tech leader’s business looks poised to benefit from artificial intelligence.

In addition to its own internal projects, Microsoft also owns a substantial stake in OpenAI — the company responsible for applications including ChatGPT and DALL-E. If you’re looking for a well-rounded AI stock, Microsoft is tough to beat.

Microsoft will even pay you to own its stock

Aided by strong profitability, Microsoft has paid a dividend since 2003 and raised its payout annually for 18 years straight. While the company’s current yield of roughly 0.7% won’t be attractive to investors looking for big payouts right away, this is a dividend growth stock that’s perfectly suited to be a set-it-and-forget-it portfolio component.

Microsoft’s business is enormously profitable, and it has plenty of room for long-term expansion. In addition to sending the company’s share price higher, profits generated on the back of AI should also help the company continue to increase the amount of cash that it returns to shareholders through dividends.

With strong business momentum, plenty of untapped AI opportunities, and an appealing returned income component, Microsoft is a top buy for investors seeking strong AI stocks.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Microsoft made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of January 16, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool has a disclosure policy.

Think Nvidia Is Too Risky? The Smartest Artificial Intelligence (AI) Stock to Buy With $1,000 Right Now was originally published by The Motley Fool

Source: finance.yahoo.com