The Federal Reserve is charged with promoting maximum employment and price stability. To achieve those goals, it uses certain monetary policy tools to push the federal funds rate higher or lower. For context, the federal funds rate is a benchmark interest rate that influences other rates across the economy, including credit cards, personal loans, and mortgages.

Ultimately, raising interest rates reduces spending and employment, which slows economic growth and brings inflation down. Conversely, lowering interest rates promotes spending and hiring, which accelerates economic growth and allows inflation to drift upward. The Federal Reserve, therefore, adjusts the federal funds target rate based on its monetary policy goals at any given time.

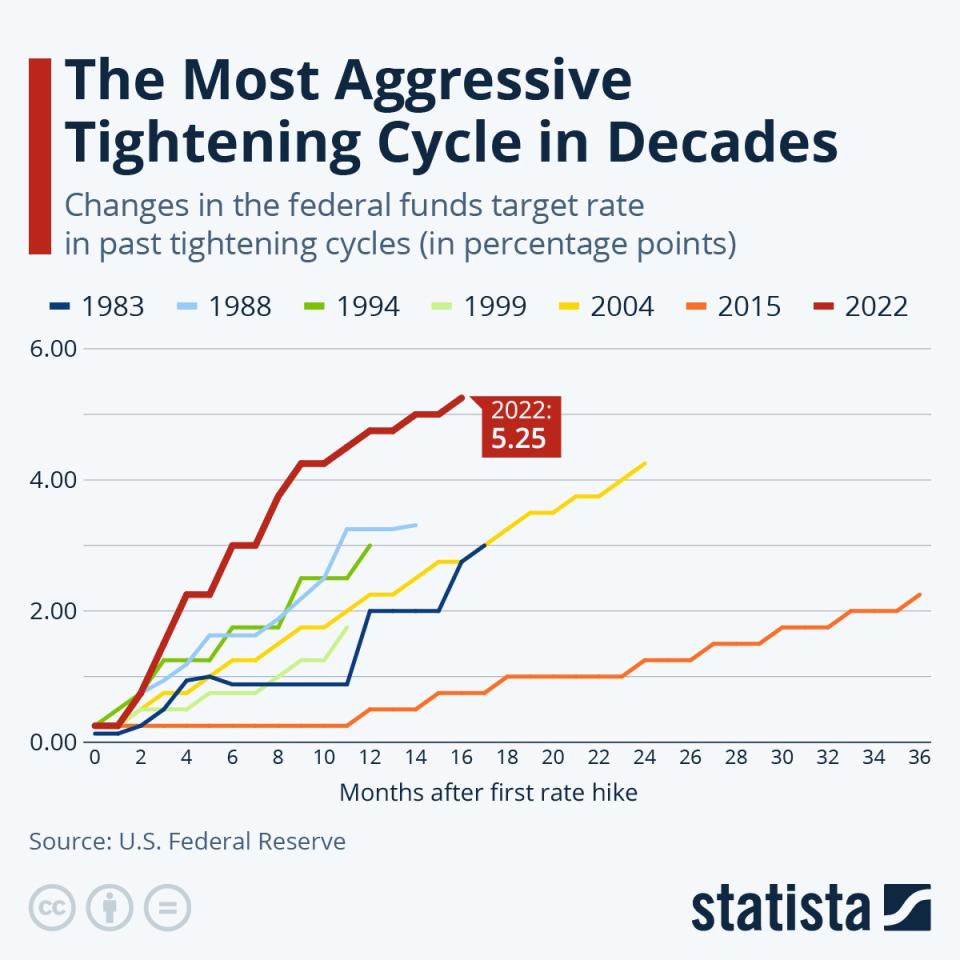

In March 2022, officials began raising the benchmark rate to cool fierce inflation brought on by stimulus payments and supply chain disruptions during the pandemic. The benchmark rate has since increased at its fastest pace in four decades, meaning credit conditions have tightened incredibly quickly. That dynamic is shown in the chart below.

Many economists feared the Federal Reserve would trigger a recession by tightening credit conditions too aggressively. But the economy has thus far remained remarkably resilient. In any case, inflation has slowed dramatically since it peaked at 9.1% in June 2022, and the Federal Reserve is now signaling an end to the rate hike cycle. In fact, the latest projections imply three 25-basis-point rate cuts in 2024.

Futures investors are expecting even more aggressive action. CME Group‘s FedWatch tool uses pricing data from futures contracts to estimate the federal funds rate in the months ahead, and it currently says the most likely outcome is six 25-basis-point rate cuts in 2024.

Historically, the end of a rate hike cycle has boded well for the stock market.

History says the stock market is headed higher in 2024

I want to make two things clear. First, stocks typically rise during the 12-month period following the end of a rate hike cycle because investors anticipate rate cuts, and cuts create a tailwind to corporate revenue and earnings by promoting economic growth.

Second, past results never guarantee future performance, so historical trends should be viewed as estimates. The most recent rate hike cycle followed a global pandemic for which there is no historical precedent, so stock market performance may not follow previous patterns.

That said, all three major U.S. financial indexes tend to increase sharply after the end of a rate hike cycle. Specifically, during the 12-month period following the last six rate hike cycles, the Dow Jones Industrial Average (DJINDICES: ^DJI) returned a median of 17%, the S&P 500 (SNPINDEX: ^GSPC) returned a median of 16%, and the Nasdaq Composite (NASDAQINDEX: ^IXIC) returned a median of 20.1%.

The post-hike cycle 12-month returns in all three indexes are detailed in the chart below:

|

Rate Hike Cycle End |

Dow Jones Return |

S&P 500 Return |

Nasdaq Return |

|---|---|---|---|

|

August 1984 |

7.9% |

13.8% |

20.4% |

|

May 1989 |

14.2% |

12.9% |

1.7% |

|

February 1995 |

40.5% |

35.7% |

41% |

|

May 2000 |

2.6% |

(12.4%) |

(41.7%) |

|

June 2006 |

19.8% |

18.1% |

19.7% |

|

December 2018 |

21.7% |

27.9% |

33.9% |

|

Median |

17% |

16% |

20.1% |

Data source: YCharts, Federal Reserve Bank of St. Louis.

For context, the Federal Reserve last raised its benchmark interest rate on July 27. Since then, the Dow Jones has increased 7%, the S&P 500 has increased 4%, and the Nasdaq has increased 4%. With that in mind, the implied upside in each index (through July 2024) is detailed below:

Here’s the bottom line: History says the stock market could notch double-digit gains during the next seven months, driven higher by the expectation that stable (or even lower) interest rates will lead to more robust corporate earnings growth. Wall Street is guiding for a similar outcome, though analysts have slightly more modest expectations.

Wall Street expects modest stock market gains in 2024

For the full year 2023, S&P 500 revenue is expected to increase by 2.3% and earnings are expected to increase by 0.6%. But Wall Street analysts believe both metrics will accelerate in 2024. Specifically, S&P 500 revenue is projected to increase by 5.5% and earnings are projected to increase by 11.5% this year, according to FactSet Research.

That acceleration in S&P 500 revenue and earnings growth could certainly drive the index higher in 2024. In fact, Wall Street analysts have a median 12-month price target on the S&P 500 of 5,090. That implies about 8% upside from its current level, a bit more modest than the upside implied by the end of the rate hike cycle.

As a caveat, the S&P 500 currently trades at 19.5 times forward earnings. That is a premium to the five-year average of 18.8 times forward earnings and the 10-year average of 17.6 times forward earnings. That tells me that many stocks are trading at elevated valuation multiples compared to their historical averages, so investors should pay close attention to valuation when buying stocks right now.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Trevor Jennewine has no position in any of the stocks mentioned. The Motley Fool recommends CME Group. The Motley Fool has a disclosure policy.

The Federal Reserve Signals Interest Rate Cuts in 2024. History Says the Stock Market Will Do This Next. was originally published by The Motley Fool

Source: finance.yahoo.com