Williams (NYSE: WMB) has a strong record of paying dividends. The natural gas infrastructure company has paid a dividend every quarter since 1974.

The company hasn’t increased its payment every year, but it has grown the payout at a 6% compound annual pace since 2018. It currently yields an attractive 5.1%, well above the S&P 500‘s 1.5% dividend yield.

The pipeline company should have plenty to continue growing its high-yielding payout. It recently added more fuel to its growth engine by making a $2 billion acquisition that will supply it with incremental cash flow while enhancing its growth prospects.

Drilling down into the deal

Williams has agreed to buy a portfolio of natural gas storage assets from Hartree Partners for nearly $2 billion. The portfolio includes six underground natural-gas storage facilities in Louisiana and Mississippi with 115 billion cubic feet of capacity.

It’s also acquiring 230 miles of natural gas transmission pipelines and 30 pipeline interconnections to high-value markets, including liquefied natural gas (LNG) markets and Williams’ Transco pipeline.

The company is paying about 10 times estimated 2024 earnings before interest, taxes, depreciation, and amortization (EBITDA) for these assets. That implies they will supply it with about $200 million of incremental earnings next year. That’s a decent amount of additional earnings for a company on track to produce $6.6 billion to $6.8 billion of adjusted EBITDA in 2023.

In addition to that incremental cash flow, the portfolio will enhance Williams’ strategic position in the Gulf Coast region. CEO Alan Armstrong commented on the deal:

This premier natural gas storage platform on the Gulf Coast fits squarely within our strategy to own and operate the best assets connected to the best markets to serve growing demand driven by LNG exports and power generation. These assets better position Williams’ natural gas storage operations to serve Gulf Coast LNG demand and growing electrification loads from data centers along the Transco corridor. Importantly, this storage will also allow us to provide value to customers in markets with growing renewables adoption as daily peaks for natural gas increases the need for storage.

The company says it anticipates that growing demand for gas in the region will drive significant earnings growth across these assets in the future.

Another move to enhance its already strong growth prospects

That acquisition is Williams’ third this year. The company recently closed two strategic acquisitions to become the third-largest natural gas gatherer in the DJ Basin in the West.

It paid nearly $1.3 billion to buy Cureton Front Range and its partner’s 50% interest in Rocky Mountain Midstream (RMM). It partly funded those deals with the $355 million sale of its Bayou Ethane Pipeline and $533 million in net proceeds from a legal judgment against Energy Transfer relating to its failed acquisition of Williams in 2016.

Williams also made three bolt-on deals in 2022 (MountainWest, Nortex, and Trace Midstream).

Williams’ acquisitions are helping enhance its already strong organic growth profile:

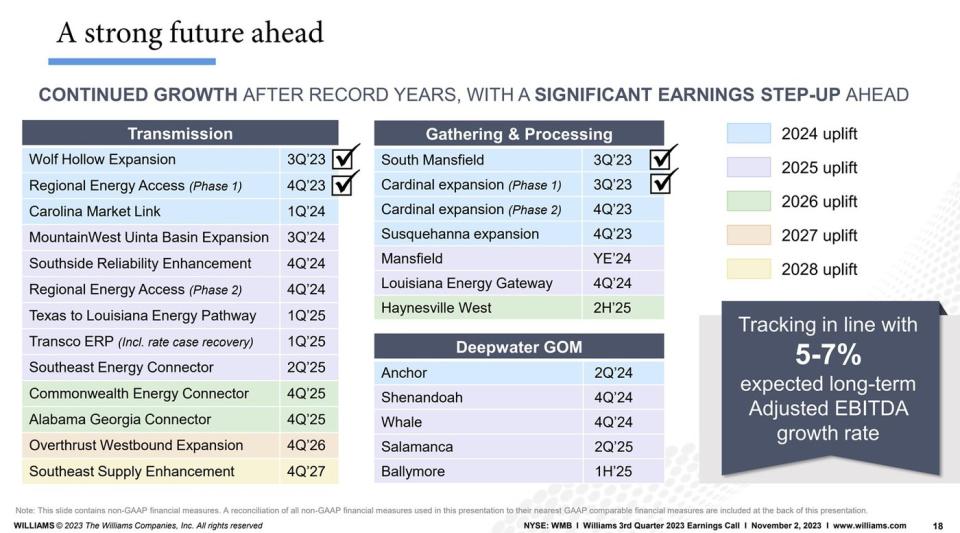

As that slide shows, Williams has a long list of capital projects currently underway to fuel growth through 2028. It’s executing several expansion projects along its Transco pipeline to boost its capacity over the next several years.

Williams also has several projects in the Gulf of Mexico on track to come on line by 2025. Those projects will double its adjusted EBITDA from the region by the end of that year.

It has also sanctioned projects related to recent acquisitions, including the Unita Basin expansion on its MoutainWest systems and DJ Basin optimization projects related to Cureton and RMM.

These projects drive Williams’ view that it will grow its adjusted EBITDA at a 5% to 7% annual rate over the long term. The biggest growth wave will hit in 2025, fueled partly by growth in the Gulf of Mexico.

The company has plenty of financial flexibility to continue enhancing growth by making more acquisitions. Williams expects to end this year with a 3.65-times leverage ratio, down significantly from 4.8 times in 2018. While its recent deals will use some of its financial capacity, the company’s growing earnings and excess free cash after paying dividends and funding capital projects will give it extra flexibility to make acquisitions in the future.

Lots of fuel to grow its dividend

Williams already had lots of growth ahead thanks to its long list of capital projects. However, the company has enhanced its profile by making acquisitions.

Its deals supply it with incremental income and upside potential. They make Williams an even more enticing stock for those seeking a high-yielding and steadily rising income stream.

Should you invest $1,000 in Williams Companies right now?

Before you buy stock in Williams Companies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Williams Companies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Matthew DiLallo has positions in Energy Transfer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This 5.1%-Yielding Dividend Stock Makes a $2 Billion Acquisition to Add More Fuel to Its Dividend Growth Engine was originally published by The Motley Fool

Source: finance.yahoo.com