With the weakness in oil prices in Q-4, producing companies have struggled, in many cases giving up 20-30% of their early November peak share prices. The $109 average realizations of Q-2, and $94 realizations of Q-3 are behind us, and these companies will report even lower realizations for Q-4. That’s baked in at this point. Wall Street has accordingly taken down valuations for these companies, and when they report in early Feb, 23, may still be further compressed. Longer term, we remain bullish on the producers as we think higher oil prices are in the offing. Pain will turn into gain for patient investors. But, that’s down the road a little bit, leaving the question as to where to look now for unrealized value in the oilfield sector.

I am always on the hunt for value, so when I went looking for companies that appeared to be positioned to do well in a $75 WTI environment, it didn’t take long for the Drilling Contractors to emerge as likely prospects. These companies are sold out or nearly so of their available Tier I “Walking” rigs, have doubled the day rates they receive for this equipment, and have been raising dividends and stock buybacks. Strangely their stock prices have not responded in kind, creating an opportunity for risk-tolerant investors.

A quick look at two ETFs that track the performance of the producers, the Energy Select Sector-SPDR ETF, (NYSE: XLE), and the SPDR S&P Oil & Gas Equipment & Services ETF, (XES) confirms a disconnect in segment performance.

In this month’s edition of our long-running oilfield comparison series, we look at two of the premiere drilling contractors in the oilfield service-OFS, space. The first, Helmerich & Payne, (NYSE:HP) has a premium offering in the Walking Rig space and some inventory that will be put to work in Q-1, 2023. The next, Patterson-UTI Energy, (NYSE:PTEN), is also a premium purveyor of these much sought-after rigs and also participates in the pressure pumping space. Both companies have good prospects in the coming year, but we will select the one we feel has a slight edge as our winner of the month.

Helmerich & Payne

HP is one of the oldest contract drillers participating in the market today with over a century of continuous service. Their longevity provides instant credibility and name recognition when courting clients. I have worked with them on projects where the fathers and grandfathers of key personnel had worked with or for HP. There is no shortage of goodwill when it comes to HP. That said, it’s a numbers game these days, and they still must be competitive on contracts. HP is mainly a U.S. driller but has rigs in major basins around the world.

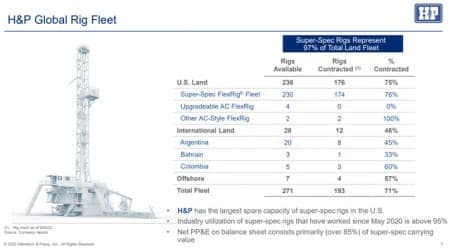

With 176 rigs turning to the right the company represents about 22% of the active U.S. fleet of 780 or so. In addition to direct drilling services, the company provides a number of ancillary drilling-related services, consisting mostly of AI modeling support and drilling efficiency software. Technologies like HP’s Bit Guidance System, provide backup to telemetry delivered third party Measurement While Drilling, Logging While Drilling-MWD, LWD, downhole tool information, to ensure that the bit stays in the reservoir to total depth-TD. This is a critical aspect of well construction and delivery and may help to eliminate an unnecessary bit trip. A bit trip (pulling out of the hole to change the bit, and re-running) costs hundreds of thousands of dollars at a minimum. Ancillary services are accretive, but not game changers for the company as they are widely replicated throughout the industry.

The key driver for HP is its fleet of Super-Spec “FlexRigs” that can walk across a drilling pad (either permanently in place or laid down for the purpose). HP has a nice video showing this feature in action, and I encourage you to give it a look. The old-school alternative to walking, is dismantling the rig sections and crane-lifting individual pieces to flatbed trucks. It’s several days of work commonly vs a few hours of walking. There is also the elimination of crane-lifting risk to personnel to which oil companies are keenly sensitive. Anything that enhances safety makes using walking rigs a no-brainer, and clients are demanding them. HP also has a good inventory of FlexRigs available for long-term contracts, representing upside to revenue and EBITDA as they go to work.

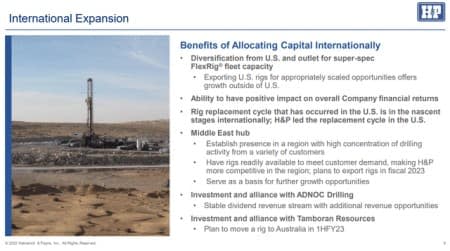

The ADNOC deal

This is a strong catalyst for growth. As part of this JV HP will sell 8-eight rigs to ADNOC drilling and take a $100 mm stake in the ADNOC IPO on the Abu Dhabi exchange. This alliance which includes technologcal support from HP to ADNOC, will give HP a hub in the MENA area to export more rigs, secure contract drilling deals, and of course, participate in the profits generated by ADNOC drilling.

Q-3, 2022

HP closed out its fiscal year in Q-3 having generated quarterly revenues of $631 million versus $550 million in the previous quarter. H&P generated $234 million in operating cash flow during fiscal 2022, which fully funded capex and the base dividend in Q3. HP has a minimal debt load of $550 mm with no maturities before 2031, $349 mm of cash on the books, and an untapped credit line of $1 bn.

HP has 180 rigs contracted, and they expect to end the first fiscal quarter with between 181 and 186 working rigs with expectations for a few additional as in early January, and with line of sight for up to 192 rigs by the end of fiscal Q2. (Q-1, by the calendar) CEO John Lindsay offered a bullish outlook for 2023 in their quarterly call.

“We expect our financial results for the first fiscal quarter of 2023 to follow the improving trend of the past two fiscal quarters, where strong demand from customers coupled with rollovers of term contracts, should continue to drive higher average levels of pricing across the active fleet.”

On September 7, 2022, the Board of Directors of the Company declared a quarterly base cash dividend of $0.25 per share, and on October 17, 2022, declared a supplemental cash dividend of $0.235 per share; both dividends are payable on December 1, 2022, to stockholders of record at the close of business on November 15, 2022, and represent a yield on cost of ~4%.

Patterson-UTI Energy

PTEN is another large contract driller with a primary focus on North America, and the U.S. shale plays in particular. Patterson also engages in the pressure pumping (fracking) business, which comprises about a third of its revenue. There is some synergy between these two businesses, as once the hole is drilled, it is ready for completion. (This may not be readily apparent to lay people, so I will provide a high-level overview of the fracking process later in this report.)

PTEN was the recipient of a recent upgrade by Raymond James analyst, James Rollyson:

“A sustained period of underinvestment during an exceptionally weak macro environment coupled with rising energy transition pressures set up the current oil supply situation, for which there is no short-term fix.”

Rollyson noted further that the OFS sector is set up for a multi-year run as tight supplies of Tier I Super Spec rigs boost day rates and margins.

Against that backdrop which we endorse, we will review key financial data reported by the company, and the macro picture we see developing for U.S. shale. PTEN seems well-positioned to thrive in the coming year, and from what we can see, for years to come. The only way to get oil out of shale is to first drill a hole in the ground, and that is what companies like PTEN are uniquely set up to do. The more holes you make in the ground, the more oil you can get.

We think there will be more holes drilled in the ground next year, than this year, and still more in the year beyond that, providing a fertile ground for PTEN to run as this market develops.

The thesis for PTEN

PTEN is a large technologically oriented contract driller with a significant number of highly sought-after Tier I, “walking rigs” that can move around on a frack pad without being broken down. This saves time and enhances the value to the client. Rigs provide about 60% of PTEN’s revenue. PTEN also runs a small fleet of frac spreads (12-13) and has recently taken steps to upgrade some of its frac fleets to Tier IV status. There is some synergy between these businesses, as once you drill a hole in the ground, and run casing, you are ready to begin the perf and plug process we know as fracking. Fracking delivers about 10% of PTEN’s revenues.

What turned me around on the drillers? It’s a fair question as traditionally I’ve been a little dour on the category, seeing them as a value trap that would keep all but the earliest investors underwater. Sometimes for years. They were typically run on spec, where an operator might tell them they were going to drill a bunch of wells and needed rigs. Drilling contractors would then oblige, borrowing the money to build them…only to be left holding the bag when oil prices dropped and the operators canceled their plans. The whole industry was run this way for most of my 38 active years in the business: boom and bust.

Things started changing a few years back as companies flirting with bankruptcy brought on by legacy debt from the last boom and perennial low oil prices, caught a break. Oil and gas prices bottomed and then began to rise, breathing life into a stagnant industry. Equipment was retired, balance sheets repaired, technology provided new sources of revenue and enhanced profits, and by the time 2022 rolled around PTEN and its peers began to see a shift in the operator/drilling contractor dynamic.

For the first time in almost a decade…it was a seller’s market.

Day rates have doubled this year to nearly $40k per day for Tier I Super Spec walking rigs. This forms an upper threshold against which rates for lower-tier rigs also rise. On the horizon are electrified rigs with the company’s proprietary EcoCell LI batteries that have eliminated 700K gallons of diesel thus far in 2022. One can presume that rigs that eliminate emissions and help mitigate diesel consumption will receive still further premium pricing.

Catalysts for growth

PTEN is reactivating and upgrading 4-rigs for delivery in 2023. Andy Hendricks, CEO, commented-

“We’re also increasing our 2022 CapEx forecast to approximately $425 million, up from the previous $390 million. The increase includes the acceleration of rig upgrades for delivery in 2023 where this CapEx is being largely funded by customers. Across the industry, pricing continues to grow as rig demand remains strong. Supply continues to be limited due to the dwindling availability of Tier-1, super spec drilling rigs combined with the overall tight labor market and challenged supply chain.”

Company filings

PTEN is also increasing the number of high-spec rigs under contract, increasing this metric by 61% in Q-3. Many are for just a year with a rollover provision that includes an escalator, Hendricks noted one three-year contract for 5-rigs.

Increasing rigs and extended contracts are bullish for PTEN stock.

Fracking begins when the well reaches total depth and the drilling assembly is withdrawn from the well. The next operation is to fracture the rock in a series of short stages that include:

-

Perforation to open a pathway into the reservoir

-

Pumping water and sand at high rates to further open the pathway and increase its permeability.

-

Running a plug to isolate the stage

-

Repeating this process (100-150X) over a three-five day period

-

Drilling out plugs and excess sand

-

Flowback and cleanup of the reservoir

Pressure pumping is provided on an hourly, pumping-time basis, with extra charges for personnel, and often includes chemicals-friction reducers, O2 scavengers, acids, and retarding chemicals as well as corrosion inhibitors. It can be very lucrative.

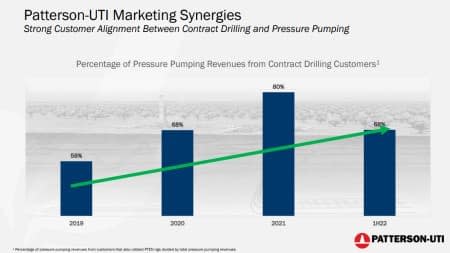

There is an advantage to the operator in lumping pumping with drilling. Service companies will assign multiservice coordinators to improve communication between the two disciplines. The advantage to the OFS is obvious as it provides another revenue service. The slide below from the Patterson investor delay shows a wide acceptance by clients with 68% of pressure pumping revenue coming from drilling clients.

Q-3, 2022

The PTEN rig count grew from 113 to 132 in 2022 with another four lower-tier customer-funded upgrades to Tier I scheduled for 2023. What’s more impressive is the growth in the late 2021 Tier I day rate from the low $20,000’s to the current $40,000’s which has led to revenues topping $702 mm for Q-3, a 64% increase from the first of the year. $288 mm of this came from pressure pumping. EBITDA grew 4X to $198 mm. Capex for the full year is set at $425 mm, including some $40 mm supplied by clients to reactivate and upgrade older rigs to Tier I status. Long-term debt stands at $852 mm.

The rise in revenue has been at increasingly profitable terms, bringing EPS (Earnings per Share), from -$.038 in Q-4 of 2021 to a positive $0.18 in Q-3, 2022. With rates at the current levels, the company is now seeking and getting longer-term 3-5 year contracts, which will stabilize cash flow at high levels for years to come. This figure may improve still further in the year to come as was noted in their Q-3 quarterly conference call where CEO Andy Hendricks commented.

“Going into next year, we expect to see further pricing increases as many of our existing contracts roll over, especially in contract drilling. As such, I believe we still have significant upside to our current margins and free cash flow.”

Company filings

They have doubled the quarterly cash dividend to $0.08 per share and increased the share repurchase authorization to $300 million. The dividend was payable on December 15, 2022, to holders of record as of December 1, 2022.

Guidance for Q-4 was given as a repeat of Q-3.

Risks

I view these companies as being substantially derisked in the current market conditions. They are generating the cash flow to cover interest payments, cover capex, fund dividends and share repurchases, and pay down debt. A collapse in oil prices would obviously impact those dynamics.

Another key risk to our thesis involves the ever-tightening political noose around the neck of American oil companies. It’s difficult to think this could get worse, but it might. In those scenarios, HP and PTEN might sink further. As recently as September, the stock hit the mid-$30s.

Risk and reward go together, so investors will have to gauge if these companies meet their individual risk profiles.

Your takeaway

As I noted above, PTEN is trading at an EV/EBITDA multiple of 5.6X. Clearly, PTEN is not going to grow at its 2022 rate in 2023. But it will experience some growth that could end up being significant. Andy Hendricks, the CEO, commented in regard to an analyst question-

“When we look at ourselves and what we will likely do with various customers and what we will likely do in terms of reactivations and some upgrades, our rig count add in 2023 is probably in that 15 to 20 rig range.”

Company filings

The upper end of that is pretty significant and could add as much as ~$200 mm of revenue and ~$65 mm of EBITDA for the year, on a back-of-the-envelope basis.

Bottom line we will probably drill about 2,000 more horizontal wells in 2023, than we did in 2022. The only way we are going to get there is with more rig upgrades and reactivations. The motivation to add to existing fleets will be increases in the day rate, and as I said earlier, it’s a seller’s market.

I think PTEN can revisit the recent highs from its current 15% discount. I wouldn’t be surprised with the market strength in shale drilling and the shift to longer term contracts, to see PTEN get awarded a higher multiple from the market. A 6X, not excessive in a rising market, would take the share price toward the middle to upper $20’s, implying ~40% growth from present levels. Now let’s look at HP.

HP is trading right now at an EV/EBITDA multiple of ~5.3X. Growth in their rig count for Q-2 to 182 and rerating of average day rates toward spot rates of ~$40K, should push revenue and cash flow toward $700 mm and cash flow toward $275 mm in Q-2. Keeping the multiple at 5.3X would require the stock to rerate toward the middle $50s. Growth such as they are delivering might as well justify a slightly higher multiple.

Analysts have an overweight rating on the stock with price targets that range from the mid-$40s to a high of $71.

The most compelling statistic for me is the amount of Super-Spec FlexRigs H&P has for quick mobilization. Over 50 of these highly sought-after rigs are available for a market that is demanding more of them, and willing to pay up to get them. The company also noted an increasing interest in multi-rig commitments for long-term contracts. This fact combined with H&P’s significantly better liquidity, less debt, and $349 mm in cash and short-term investments tips the scale to them in this month’s contest.

Investing in the OFS sector and particularly in the Drilling Contractors, the premier one being Helmerich & Payne, is an excellent way for investors to take advantage of a discount currently being offered on shares of these companies. When the market turns back to concerns about supply, as I think it is now in the process of doing, shares of H&P and PTEN could rerate higher quickly. For now, our top pick to play this segment rotation is H&P.

Read this article on OilPrice.com

Source: finance.yahoo.com