After July’s exceptional surge, the markets steadied during early August with the S&P 500 up by a third of a precent over the past week. Now investors will be keen to find out if the rally has legs.

Stifel’s chief equity strategist Barry Bannister thinks it does and believes the S&P 500 is on course to reach 4,400 during the year’s second half, explaining that the sell-off in 1H22 is “still being reversed.” The strategist also thinks the S&P 500’s “equity risk premium” now suggests a mid-point price target of 4,400.

If the uptick is set to continue, then fresh opportunities will obviously open up for investors.

With this in mind, we delved into the TipRanks platform and homed in on 3 names which for various reasons the Street’s experts believe are primed to push ahead over the coming months. All three fit a certain profile; rated as Strong Buys by the analyst consensus and set to potentially double or more in the year ahead. Let’s take a closer look at why they are drawing such optimistic outlooks.

Lulu’s Fashion Lounge Holdings (LVLU)

We’ll start with an e-commerce company in the consumer discretionary spending realm. Lulu’s Fashion Lounge is an online, ‘digitally native,’ one-stop shop for women’s fashion. The company offers a range of on-trend and high-quality fashions, including dresses, blouses, shirts, jackets, coats, skirts, pants, footwear, and accessories, in all shapes and sizes. Lulu’s products are available worldwide, solely through the website.

The company traces its history back to 1996, but went public less than 9 months ago, in November of last year. The IPO raised $92 million, short of the hoped-for $100 million, and the stock has seen high volatility since. It closed its first day’s trading just over $13, peaked above $19 in June of this year, and is currently down 56% from its first closing price.

During this time, Lulu’s has reported strong revenues, with the top line hitting $111.9 million in the first quarter of fiscal 2022, which ended on April 3 of this year. This total was up 62% year-over-year, and supported a net income of $2 million, up $3.4 million for the year-ago quarter’s net loss. The company’s gross profit grew 70% when compared to the first quarter of last year.

Looking ahead, Lulu’s has released preliminary 2Q data, showing the company expects second quarter revenue to reach a range between $131 million and $132 million and earnings to come in between $5.6 million and $6.2 million. While representing considerable growth sequentially, these results were considered somewhat disappointing on the Street, as the earnings prediction is significantly lower than the $8.3 million from last year’s Q2. Shares fell 23% when the preliminary numbers were released.

Despite the pullback in guidance, Jefferies analyst Randal Konik sees an opportunity here. He writes of Lulu’s, “In our view, LVLU continues to solidify itself as a brand of choice for today’s younger generation of fashionconscious consumers. With consumption patterns moving towards ecomm and the industry highly fragmented, we believe the runway for growth is significant at Lulus. Therefore, with valuation multiples subdued due to the recent market pullback, we see high probability of multiple expansion driving an increase in LVLU shares from current levels.”

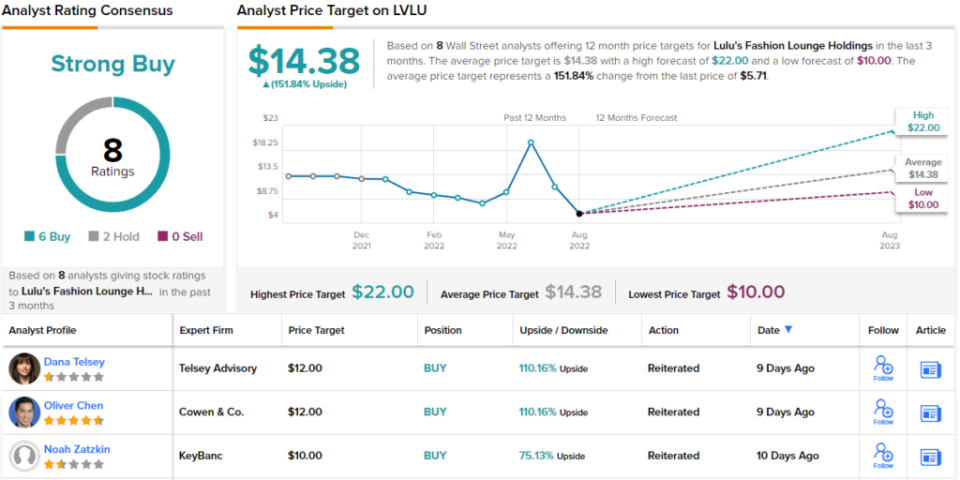

Looking forward from these comments, Konik rates the shares as a Buy, and his $22 price target suggests an upside of 285% for the coming year. (To watch Konik’s track record, click here)

Overall, it would seem that the Street agrees with Konik’s bullish take. The stock has 8 recent analyst reviews and they break down 6 to 2 in favor of the Buys over the Holds. The shares are trading for $5.71 and the average price target of $14.38 indicates potential for gains of 152% this year. (See LVLU stock forecast on TipRanks)

Kinnate Biopharma (KNTE)

The second stock on our list, Kinnate Biopharma, is a clinical-stage company focused on cancer research and the development of new, targeted, therapeutic agents. The company’s research program is creating small molecule kinase inhibitors designed to treat difficult genomically-defined malignancies. Kinnate aims to hit cancers at the source of the tumor, to prevent a more dangerous metastatic disease.

Kinnate currently has four active research tracks, featuring three drug candidates. Two drug candidates are undergoing three Phase 1 clinical trials, while the third candidate is still at the pre-clinical stage.

The leading drug candidate, KIN-2787, a pan-RAF inhibitor, is the subject of two Phase 1 trials. The first of these is a monotherapy trial testing the drug against melanoma, lung cancer, and other solid tumor diseases, and initial data from this study is expected for release in 4Q22. The second clinical trial, also at Phase 1, is testing KIN-2787 as a combination therapy with binimetinib in the treatment of NRAS-mutant melanoma; the company looks to release initial data from this trial in 1H23.

Kinnate’s second main drug candidate, is an FGFR inhibitor called KIN-3248. This drug candidate targets alteration in the FGFR2 and FGFR3 genes that are associated with cancer growth. The Phase 1 trial underway is a first-in-human dose escalation study in adult patients; the first patient was dosed this past April.

On the financial side, Kinnate finished the first quarter of this year with $302.4 million in cash and liquid assets. With first quarter R&D and G&A costs combined reaching $27 million, this gave Kinnate a cash runway, as of March 31, for 11 quarters of operations. The company is scheduled to release 2Q22 numbers in mid-August.

In July, H.C. Wainwright analyst Robert Burns initiated coverage of this stock, writing of the company’s leading research track, “While we acknowledge the competitive landscape, we point out three differentiating factors for KIN-2787, including: (1) a highly KIN-2787 highly selective kinome, which could lead to reduced off-target toxicities; (2) a lack of paradoxical reactivation with KIN-2787. This is notable because paradoxical reactivation typically limits anti-tumor activity; and (3) improved aqueous solubility, higher free fraction, and increased drug exposure relative to LXH-254 and belvarafenib, which all enhance the likelihood that KIN-2787 may achieve greater target coverage in the clinical setting, in our view.”

Burns started his coverage with a Buy rating and a $33 price target implying an upside of 150% on the one-year time horizon. (To watch Burns’ track record, click here)

Even though this biotech’s pipeline is in the early stages, and is still a zero-revenue firm, it has picked up positive attention from the Street. The 5 recent analyst reviews all agree that this is a stock to Buy, making the Strong Buy consensus unanimous. Shares in Kinnate are trading for $13.18 and their $31.25 average price target indicates a 137% upside from this level. (See KNTE stock forecast on TipRanks)

Nkarta, Inc. (NKTX)

Last up on this list is Nkarta, another clinical-stage biopharmaceutical company. Like many biopharmas at the start of the clinical process, Nkarta is pre-revenue and runs at a loss – but its interesting approach to cancer treatment should spark investor attention. Nkarta is working on the development of off-the-shelf, allogenic engineered natural killer (NK) cell therapies. This approach aims to create a cell therapy that is both more potent and better tolerated than current tech allows and will have broad applications to multiple hematologic and solid tumor cancers.

Nkarta currently has two programs in clinical trials, and two more in pre-clinical discovery. The first clinical-stage drug candidate is NKX101, which was engineered to treat NKG2D ligands whose targets are selectively overexpressed in cancer cells. The drug candidate is currently undergoing a Phase 1 clinical trial which is demonstrating an encouraging safety profile. Preliminary data from the study, albeit limited in number of patients, has also shown potential efficacy against hematologic cancers.

The second clinical-stage drug candidate, NKX019, has also had a positive preliminary data readout from the Phase 1 clinical trial. This trial is targeting a specific B-cell antigen, CD19, and is administered as a multi-dose, multi-cycle monotherapy for patients suffering from r/r B-cell cancers. NKX019 has shown that it is well-tolerated by patients.

Both of these drug candidates are in continuing trials, and additional clinical data from the ongoing dose escalation studies are expected in 2H22.

NKarta, like Kinnate above, has a solid cash reserve on hand, totaling $219.1 million in liquid assets. This can be set against expenses for research and development and general administration totaling $26.1 million for 1Q22, and suggests that, as of March 31, the company had resources sufficient for 8 quarters of operations.

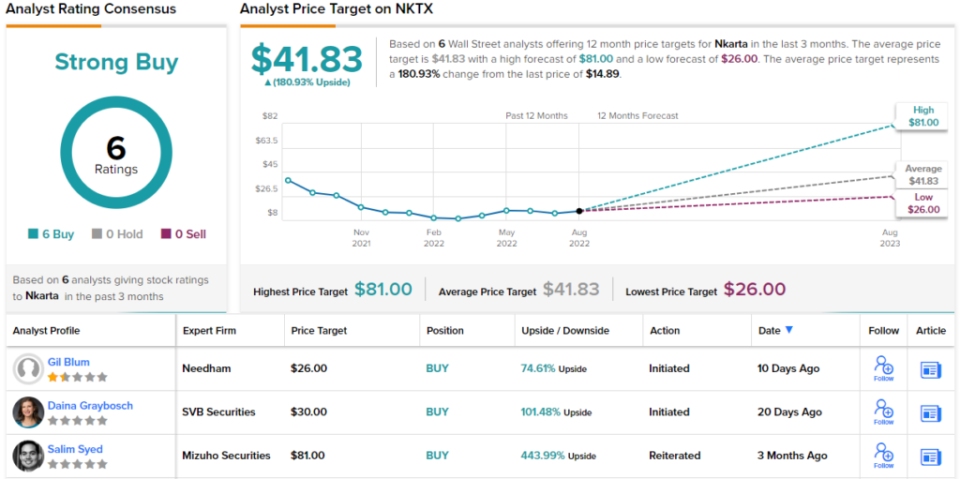

SVB analyst Daina Graybosch opened her coverage of this stock last month with upbeat commentary, saying, “[We] believe Nkarta is well positioned to compete given the company’s deep biologic expertise of NK cells, as evinced by extensive publication on programs and fundamental biology… The company breaks ground on commercialscale GMP manufacturing this summer, which we believe may be attractive to acquirers. Further, the company’s collaboration and licensing of CRISPR-Cas9 gene-editing technology with CRISPR Therapeutics enables Nkarta to better and more quickly develop highly engineered, competitive NK cell products, while we also see compelling rationale for combining CAR-NK and CAR-T…”

Along with her comments, Graybosch gave NKTX an Outperform (or Buy) rating, and her $30 price target suggests the stock has a one-year gain of 101% ahead of it. (To watch Graybosch’s track record, click here)

Again, we’re looking at a stock with a unanimous Strong Buy consensus rating from the Street. There are 6 recent analyst reviews here, and all are positive. Nkarta’s shares are trading for $14.89 and have an average price target of $41.83, giving the stock a one-year upside potential of 181%. (See NKTX stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source: finance.yahoo.com