The first company to reach a $4 trillion stock market valuation may not even be on your radar screen now. While almost everyone expects one of the three largest U.S. companies — Microsoft MSFT, Apple AAPL and Nvidia NVDA as of June 14 — to be the first to hit that milestone, it isn’t necessarily a given.

True, if the shares of these three Big Tech companies were to appreciate at no faster than the U.S. market’s average historical rate, they would each hit the $4 trillion market in just over three years. Yet many Wall Street analysts expect each of these three companies to grow much faster than that, and pass the $4 trillion mark much sooner.

Most Read from MarketWatch

But they are extrapolating the recent past into the future. If Nvidia’s stock in the coming months were to continue appreciating at the same rate as it has over the past year, for example, its market cap would hit the $4 trillion mark by year-end. One Wall Street analyst is even projecting that Nvidia will do just that and reach the $5 trillion mark next year.

These analysts are getting ahead of themselves. Not only is it unrealistic to extrapolate the recent past into the future, it’s unrealistic to expect that these market-cap leaders will grow at the market’s average rate. After stocks make it to the top of the market cap rankings, they proceed to grow at a below-market rate, on average.

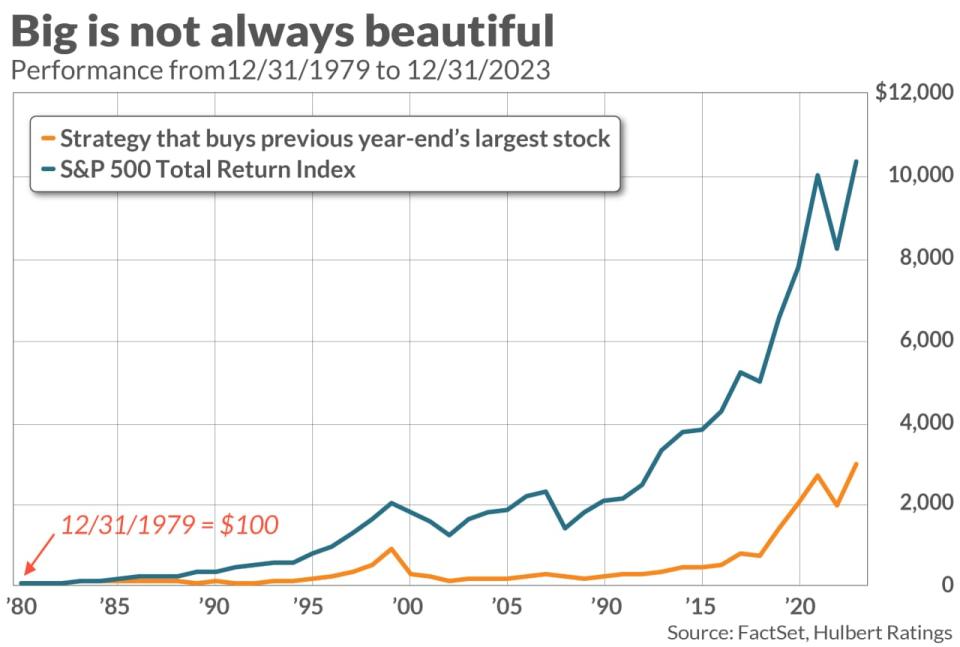

This is illustrated in the accompanying chart, which plots the performance of a hypothetical strategy that each year invested in the U.S. stock with the largest market cap at the end of the prior year. Notice that the strategy significantly lags the S&P 500 SPX.

Fans of Nvidia in particular are incredulous when I present this data to them. Don’t I know that the AI revolution is just beginning? It’s obvious (to them) that not only will the AI wave continue for many years to come, but also that Nvidia will be at the head of that wave, producing double-digit, if not triple-digit, annualized returns.

What these true believers fail to realize is that if something is obvious, it’s already reflected in the market. For Nvidia to grow at the rates they are anticipating, the company would have to perform far better than they are already expecting. And that’s expecting a lot, as I recently discussed: Nvidia’s current price assumes that its earnings per share will grow at a 70% annualized rate over the next five years. Hardly any large-cap stock earnings in U.S. history have grown that fast for that long.

Top dogs and dark horses

Even if AI stocks continue taking Wall Street by storm, it’s unlikely that Nvidia’s stock in coming years will be the AI leader. That’s the implication of a 2019 study conducted by investment company Research Affiliates, entitled “Standing Alone Against the Crowd.” The study’s authors focused on stocks that, at any point over the prior 40 years, had the largest market caps “in each sector of the nine largest stock markets in the world” — stocks they referred to as “top dogs.”

They found that “nearly 80% [of the top dogs] underperformed their own sector over the next decade, falling short of the average return for that sector in each country by an average of 9.7% a year.”

This is why we shouldn’t be surprised if a dark horse stock is the first to $4 trillion. It’s impossible to know which stock it will be, since if we knew, the stock would already be trading close to that level. But there are many stocks that are lower down the market cap ranking that are in the running. All it would take would be for fortune to smile on one of them the same way it has for Nvidia.

To appreciate this point, imagine yourself three years ago trying to predict which company would first hit the $3 trillion mark. At the time (June 30, 2021), Apple was at the top of the market-cap rankings, at $2.28 trillion. Microsoft was in second place at $2.04 trillion, while Amazon.com AMZN was third at $1.73 trillion. Nvidia’s market cap then was $498 billion. Few would have guessed that three years later, Nvidia’s market cap would surpass Apple’s, as happened earlier this month.

To identify which dark horse stocks might end up with bragging rights as the first $4 trillion company, I took Nvidia’s return over the past three years and calculated what each stock in the S&P 500 SPX would be worth in three years if it grew at that same rate until then. On this assumption, eight stocks besides today’s big three would be worth more than $4 trillion in June 2027:

It would be no more surprising for any one of these stocks to rise to the top of the market cap rankings than it was for Nvidia to have done so.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at

Also read: Microsoft, Nvidia and Apple are racing toward $4 trillion. What will decide who gets there first.

Most Read from MarketWatch

Source: finance.yahoo.com