Right now, there are only seven companies in the world with a market capitalization in excess of $1 trillion. Ranked in order from largest to smallest, those companies are Microsoft, Apple, Nvidia, Alphabet, Amazon, Saudi Arabian Oil, and Meta Platforms.

The obvious theme here is that most of these companies operate in the technology sector. Moreover, within technology, Microsoft, Alphabet, and Amazon all share something else in common: Each of them is a dominant force in cloud computing and artificial intelligence (AI).

Beyond mega-cap tech enterprises, I see another player quietly emerging at the intersection of cloud AI infrastructure. Let’s break down how Oracle (NYSE: ORCL) is making notable strides in AI, and analyze the company’s path to a trillion-dollar valuation.

Oracle’s greenfield opportunity

According to Statista, Amazon is the top cloud infrastructure provider with 31% market share as of the end of the first quarter this year. Microsoft and Alphabet round out the top three, with 25% and 11% market share, respectively. With just 2% market share, Oracle trails its big tech cohorts by a considerable margin.

However, Oracle’s operating results over the last several quarters are quite impressive. For example, through the first nine months of Oracle’s fiscal 2024, ended Feb. 29, the company’s cloud services revenue grew 26% year over year to $14.5 billion. In the most recent quarter specifically, cloud services increased 25% year over year to $5 billion. By contrast, Amazon’s cloud business grew 17% year over year in its most recent quarter.

Although Amazon is a much larger cloud operation, Oracle is currently growing at a faster pace. I think this demonstrates that cloud infrastructure, in general, is experiencing accelerated growth, and businesses are using platforms outside of the top three providers. These secular tailwinds should bode well for Oracle over the long run.

Demand is at record levels

Outside of revenue, one of the most important metrics that Oracle reports is remaining performance obligations (RPO). RPO is important because it provides investors with a preview of revenue that has been booked but not yet recognized.

At the end of the most recent quarter, Oracle’s RPO grew 29% year over year and reached an all-time high of $80 billion. Furthermore, during the earnings call, management told investors that roughly 43% of these RPOs will be recognized as revenue over the 12 months.

Considering Oracle’s backlog is growing faster than its reported revenue, I think it’s safe to say that demand for the company’s cloud services is robust.

Can Oracle become a $1 trillion business?

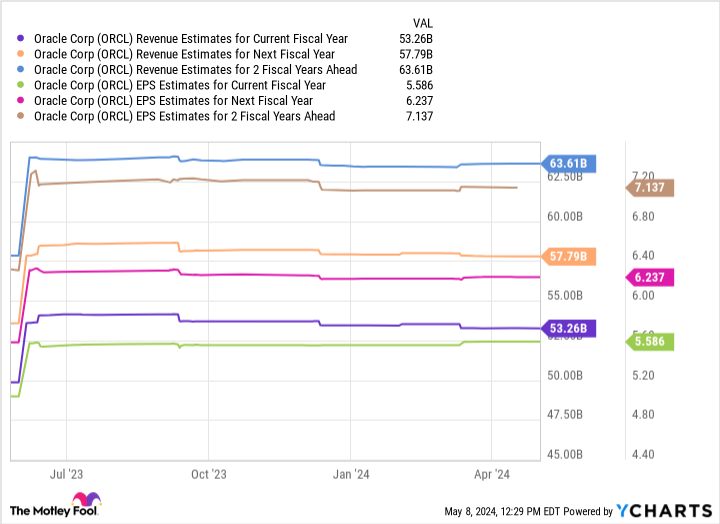

The chart below illustrates consensus analyst estimates for revenue and earnings per share (EPS) for Oracle over the next couple of years. While these metrics are expected to accelerate, the growth rates might appear somewhat muted compared to other software-as-a-service (SaaS) providers.

One reason for this is that Oracle is experiencing declining growth in its on-premise business. Through the first nine months of fiscal 2024, Oracle’s on-premise cloud operation generated $3.2 billion in revenue — a decrease of 11% annually.

While this may look like a blemish or even a risk, it actually makes some sense. As on-premise services continue migrating to the cloud, Oracle actually has an opportunity to transition this decelerating component of its business to a new growth leg.

Considering Oracle’s position in the cloud market relative to larger players, such as Microsoft, Amazon, and Alphabet, the general consensus is that the company will take longer to scale, a view I’m aligned with.

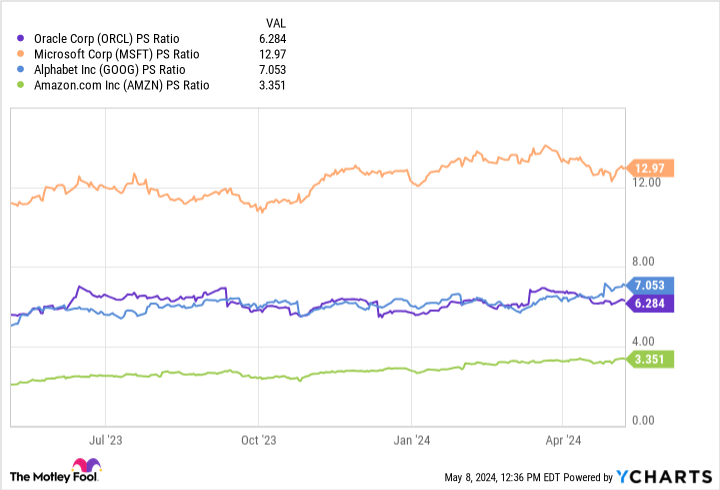

Right now, Oracle’s market cap is roughly $320 billion and the company trades at a price-to-sales (P/S) multiple of just 6.3. It’s easy to see that Oracle trades at a considerable discount to Microsoft specifically, and is trading modestly lower than Alphabet.

Considering the rate at which Oracle is growing, combined with its opportunity to turn its on-premise business into a major growth engine, I think there is a good argument to be made that the company’s valuation could rise considerably over a long-term horizon — possibly making the estimates above somewhat conservative.

In other words, as cloud database management continues to be an important pillar of the overall AI narrative and digital transformation efforts at the enterprise level, Oracle’s valuation multiples should eventually see some notable expansion and the company could one day reach trillion-dollar status.

But what investors must realize is that this transition is going to take time. I think Oracle has shown some legitimate progress in an otherwise heated cloud market. I see Oracle as a tremendous buying opportunity among cloud infrastructure businesses, and holding the stock for the long term should result in considerable gains.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: This Artificial Intelligence (AI) Cloud Stock Will Join Microsoft, Alphabet, and Amazon in the $1 Trillion Club was originally published by The Motley Fool

Source: finance.yahoo.com