The AI wars are starting to heat up.

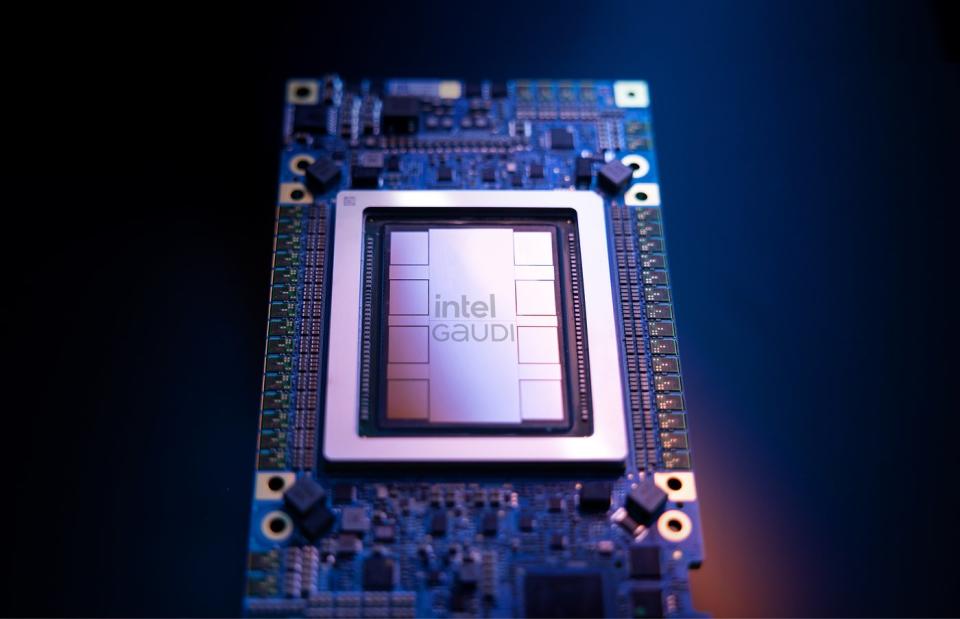

Up until now, Nvidia (NASDAQ: NVDA) has dominated the market for AI chips with an estimated 98% share of the data center GPU market. However, Intel (NASDAQ: INTC) is now throwing its hat into the ring — the company launched its Gaudi 3 AI accelerator on Tuesday.

According to Intel, the new chip is well-positioned to grab market share from Nvidia. Intel claims:

-

The Gaudi 3 delivers 50% better inference on average and 40% better power efficiency on average than the Nvidia H100

-

The Gaudi 3 sells for a fraction of the H100’s cost.

-

Intel said the new chip would be available to serve manufacturers like Dell Technologies, Hewlett Packard Enterprise, Lenovo, and Super Micro Computer.

-

It also announced new Gaudi customers and partners such as Bharti Airtel, Bosch, IBM, and NielsenIQ.

Wall Street had a mostly tepid reaction to the news. Intel stock rose 1% on Tuesday on high volume, before sliding 3% on Wednesday on concerns related to the hotter-than-expected inflation report.

Though Intel stock soared through 2023 on hopes for a cyclical recovery in the semiconductor sector and excitement around AI, the stock has fallen flat in 2024, down 26% year to date, even as the rest of the chip sector has continued to climb on the AI boom. Intel tumbled in January on disappointing guidance in its fourth quarter, and the stock fell sharply just last week as the company revealed a $7 billion loss in its foundry segment in 2023 after it restructured its business segments. The company said that loss would expand this year before it moves toward break-even in the foundry biz by 2027, and then profitability from then on.

Intel has a long history of underperforming its peers, and the stock is still down from its peak during the dot-com boom. Over the last decade, Intel shares have gained 38%, compared to a 176% gain for the S&P 500. However, the Gaudi 3 gives the company a shot at redemption.

What Gaudi 3 means for Intel

To get a sense of the opportunity in data center GPUs, you only have to take a peek at Nvidia’s recent results. The leading AI chip company brought in $18.4 billion in data center revenue in its fourth quarter, up 409% from the quarter a year ago. By contrast, Intel reported a 10% decline in data center revenue to $4 billion.

The good news for Intel is that it doesn’t have to take much market share from Nvidia to move the needle in AI chips — even $1 billion in revenue per quarter would be meaningful.

There are still significant shortages of Nvidia’s AI superchips like the H100, and its components are selling at a premium, which puts Intel in a good position to take some market share. However, putting a meaningful dent in Nvidia’s AI leadership won’t be so easy.

Nvidia steps up its game

Intel’s press release and white paper on Gaudi 3 tout its performance against Nvidia’s H100 accelerator, attributing its better throughput and inference to its large high-bandwidth memory (HBM), its more efficient architecture, and its HBM capacity.

The problem with that comparison for Intel is that Nvidia’s H100 is about to be replaced by the Blackwell platform it announced at its developer conference last month. According to Nvidia, Blackwell is four times faster than the H100 and can run trillion-parameter large language models at up to 25x less cost and energy needs than the H100.

Intel’s Gaudi 3 may have narrowed the gap with the H100, but Nvidia is still winning the AI race with Blackwell, which is expected to be available later this year.

Additionally, Nvidia’s CUDA software platform, which includes developer tools and libraries to assist with building AI applications, also gives Nvidia an advantage over challengers like Intel, which is trying to match CUDA’s capabilities with an open-source platform.

Finally, Intel’s cost advantage might also be less of a benefit than it seems. There are billions and billions of dollars sloshing through the generative AI market right now, and investors and companies are willing to shell out at this stage to gain a sustainable edge in generative AI, which could be a multi-trillion-dollar market.

While some customers may be more price-sensitive than others, computing capabilities, speed, and capacity are the key elements that Nvidia, Intel, and others like Advanced Micro Devices are competing on here, rather than price.

For Intel, dethroning Nvidia will be difficult — the AI chip leader has been investing in this technology for several years, has a complementary software platform in CUDA, and will fight for market share in what’s now the vast majority of its revenue.

Intel may pick off enough revenue to make investors happy, but it’s unlikely the Gaudi 3 will lead to a wholesale shift in AI leadership from Nvidia to Intel. Nvidia investors shouldn’t be worried at this stage.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and International Business Machines and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Intel Unveiled Its New Artificial Intelligence Chip — Can It Compete With Nvidia? was originally published by The Motley Fool

Source: finance.yahoo.com