Snowflake‘s (NYSE: SNOW) new CEO, Ramaswamy Sridhar, has been busy in addition to running his company. Recently, he completed the purchase of more than 31,000 shares for just under $159 on the open market. That amounts to around $5 million, so he’s making an obvious statement on Snowflake’s stock price.

This is significant, as Snowflake’s stock fell nearly 20% in the day following its fourth-quarter fiscal year 2024 (ending Jan. 31) earnings report, when outgoing CEO Frank Slootman announced his retirement. This report was quite positive, and the negative reaction was largely due to Slootman’s unexpected retirement.

With the new CEO loading up on shares, is this your sign to also buy the dip?

Snowflake’s business is well-positioned for the current environment

Legendary investor Peter Lynch once said: “Insiders might sell their shares for any number of reasons, but they buy them for only one: They think the price will rise.” That’s a pretty good basis to stand on, but there’s more to it than that.

The CEO of a company has more information about demand and future business streams than any investor does. So, it’s wise to take notice if they think the stock will go up based on their insider information and are buying shares on the open market.

Snowflake is also a vital software platform for artificial intelligence (AI). AI models require vast amounts of data, but collecting and efficiently storing this data can be challenging. That’s where Snowflake comes in.

Its data cloud platform helps its users collect data in many different formats, store it on their cloud provider of choice, and utilize the data to feed programs or perform data science. Snowflake has cemented itself as a vital product in a data-driven age, and its growth is far from complete.

Snowflake’s latest results were strong from a growth standpoint

Snowflake’s Q4 FY 2024 results were strong despite the market’s reaction. Product revenue was up 33% year over year to $738 million, and management gave guidance for 27% revenue growth in the first quarter.

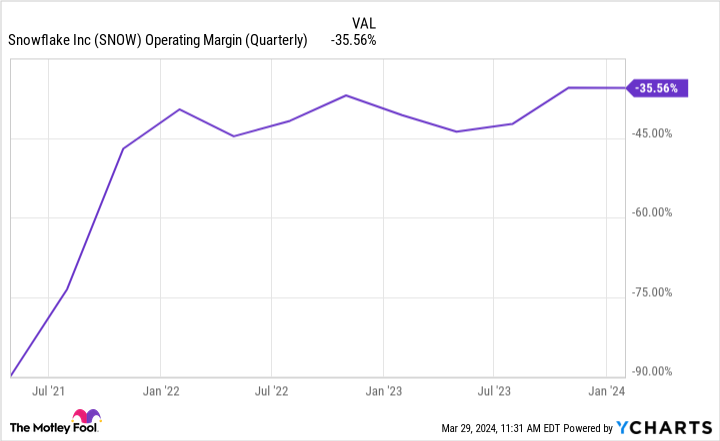

While Snowflake was still unprofitable in Q4 (it had an operating margin loss of 36%), it improved from last year’s 41% loss margin. Still, it will be a while before Snowflake investors see any profits, so this may not be your stock if you want to invest solely in profitable businesses.

After the sell-off generated by these results, Snowflake’s price-to-sales (P/S) valuation plummeted to some of the lowest levels in company history. Now, it still trades at just shy of 19 times sales, which is a very expensive stock in the grand scheme of things. But it’s a significant drawdown from the high-20s range it traded at just days before the report.

So the question becomes: Is the premium you have to pay for the stock worth it? I’m going to side with Ramaswamy Sridhar and say yes. Snowflake has become an integral part of data collection and storage, making it an indispensable software. With the business world just at the tip of the AI revolution, we have yet to realize how much data will be required to create top-notch AI models.

I’d say it’s a great time to buy Snowflake stock on the dip, but you’ll need to be patient as Snowflake’s opportunity stretches out for several years. As a result, you should be committed to owning the business for a similarly long amount of time.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 1, 2024

Keithen Drury has positions in Snowflake. The Motley Fool has positions in and recommends Snowflake. The Motley Fool has a disclosure policy.

Snowflake CEO Buys $5 Million of Shares. Here’s Why That’s a Sign to Buy the Dip was originally published by The Motley Fool

Source: finance.yahoo.com