The Dow Jones Industrial Average (DJINDICES: ^DJI) is the oldest of the three major stock market indexes in the United States. It was first calculated by Charles Dow as a daily average of 12 industrial stocks in 1896, but the index has since expanded in size and scope. Today, the Dow Jones tracks 30 stocks that span 9 of the 11 market sectors. Only real estate and utilities are not represented.

The Dow Jones is generally seen a barometer for blue chip stocks. While inclusion in the index is not governed by strict rules, the selection committee focuses on companies with excellent reputations and a history of sustained growth, especially when those businesses garner widespread interest among investors. With that in mind, Amazon (NASDAQ: AMZN) was added to the Dow Jones in February, replacing Walgreens Boots Alliance. That alone is little cause for celebration, but another development should pique investors’ interest.

Despite gaining 950% over the past decade, analysts at JPMorgan Chase still selected Amazon as their “best idea” in 2024, citing three reasons the company could create more shareholder value:

-

Cloud revenue should accelerate due to demand for generative artificial intelligence.

-

Amazon should gain share in e-commerce as a result of improved delivery speeds.

-

Finally, margins should expand as advertising sales increase and the company focuses on cost control.

Here’s what investors should know.

Amazon was firing on all cylinders in the fourth quarter

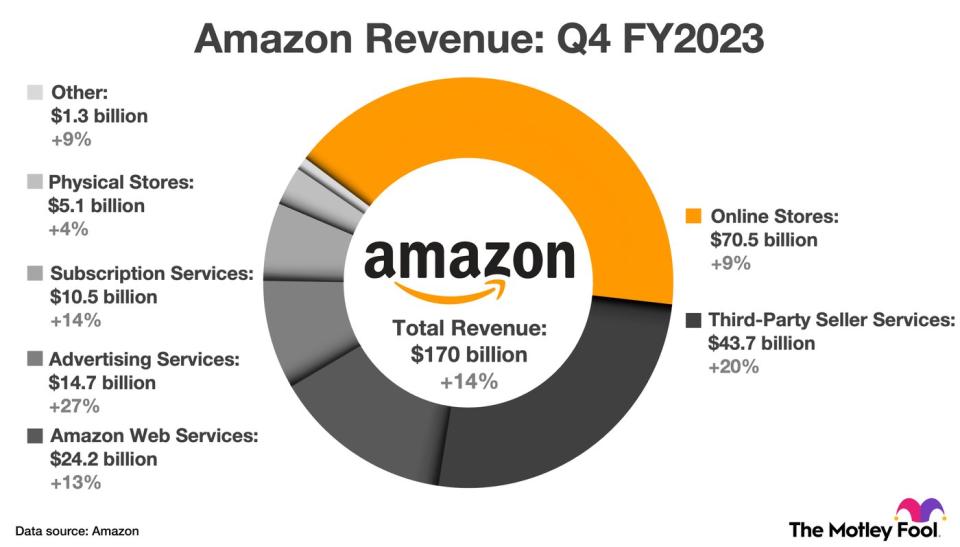

Amazon reported stellar financial results for the fourth quarter, exceeding expectations on the top and bottom lines. Revenue rose 14% to $170 billion as growth accelerated sequentially across every business segment except physical stores. Sales growth was particularly strong in advertising services and third-party seller services.

Operating margin expanded 600 basis points to 7.8%, and GAAP net income soared to $1.00 per diluted share, up from $0.03 per diluted share in the prior year. Those improvements were driven by cost-control efforts and the regionalization of fulfillment hubs, which has made its logistics network more efficient. In fact, Amazon delivered packages to Prime members at the fastest speeds in its history in 2023, while simultaneously lowering per-unit logistics costs for the first time since 2018.

The chart below visualizes Amazon’s fourth-quarter revenue across each business segment.

Going forward, investors can expect Amazon to maintain its momentum. The company has a strong presence in e-commerce, digital advertising, and cloud computing, and CEO Andy Jassy believes investments in artificial intelligence (AI) products will yield tens of billions of dollars in revenue in the coming years.

To quantify those opportunities, online retail sales are forecast to increase by 8% annually through 2030, while digital advertising and cloud computing sales are expected to grow at an annual pace of 15% and 14%, respectively, during the same period. Meanwhile, AI spending is projected to compound by 37% each year.

Amazon has a strong presence in e-commerce, retail advertising, and cloud computing

Amazon operates the most popular online marketplace in the world as measured by monthly visitors. That creates a particularly strong network effect, which affords the company a durable economic moat. But Amazon has further fortified its castle by supporting sellers with logistics and advertising services, as well as engaging consumers with its Prime membership program. Those adjacencies make its marketplace even more convenient and compelling.

Amazon has used its success in retail to build a booming advertising business. It accounted for 75% of retail advertising revenue in the U.S. last year, 10 times more than the closest competitor. That is noteworthy because retail media will be the fastest-growing advertising channel through 2027, according to eMarketer. Amazon is also the third-largest adtech company in the world, and the recent addition of advertising to Prime Video creates a new monetization opportunity.

Finally, Amazon Web Services (AWS) is the leader in cloud infrastructure and platform services, including AI developer services. That success is a product of continuous innovation. AWS offers the broadest and deepest set of cloud capabilities on the market, according to consultancy Gartner, which puts the company in an enviable position for two reasons.

First, JPMorgan analysts estimate that just 10% of IT spending is in the cloud today, meaning investors can expect many years of robust growth as more businesses move more workloads to the cloud. Second, Argus analysts believe “AWS is uniquely positioned in the burgeoning AI-as-a-service market” due to its leadership in cloud computing, which means the company is likely to be a major winner as the AI boom progresses.

With that in mind, Amazon is also investing in AI product development at every layer of the AI stack, as detailed below:

-

Infrastructure layer: Amazon designed custom chips for AI training and inference, called Trainium and Inferentia, that offer better pricing than the currently available alternatives. While they cannot outperform Nvidia GPUs, they are more cost effective in certain situations.

-

Model layer: Bedrock is a cloud service that lets businesses customize large language models from Amazon and partners like Anthropic. Those tailored models can then be incorporate into generative AI applications.

-

Application layer: CodeWhisperer is a generative AI coding assistant that helps software developers work more efficiently. Amazon Q is a generative AI business assistant that can query data and summarize information from various internal and external sources.

Amazon shares trade at a reasonable price

To summarize, Amazon operates the most popular e-commerce marketplace in the world. It has also become the largest retail advertiser and the third-largest adtech vendor. Finally, AWS is the market leader in cloud computing and AI developer services, and the company is building new products that address every layer of the AI stack.

Collectively, that puts Amazon on a glide path to double-digit sales growth for many years to come. Indeed, Wall Street anticipates annual growth of 11% over the next five years, but that estimate leaves room for upside if Amazon is especially successful in monetizing AI. Either way, the current valuation of 3.3 times sales is a reasonable price to pay. Investors should feel comfortable buying a small position in this newly minted Dow Jones stock today.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 1, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has positions in Amazon and Nvidia. The Motley Fool has positions in and recommends Amazon, JPMorgan Chase, and Nvidia. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

Meet the Newest Artificial Intelligence (AI) Stock in the Dow Jones: It Soared 950% Over the Last Decade and It’s Still a Top Buy was originally published by The Motley Fool

Source: finance.yahoo.com