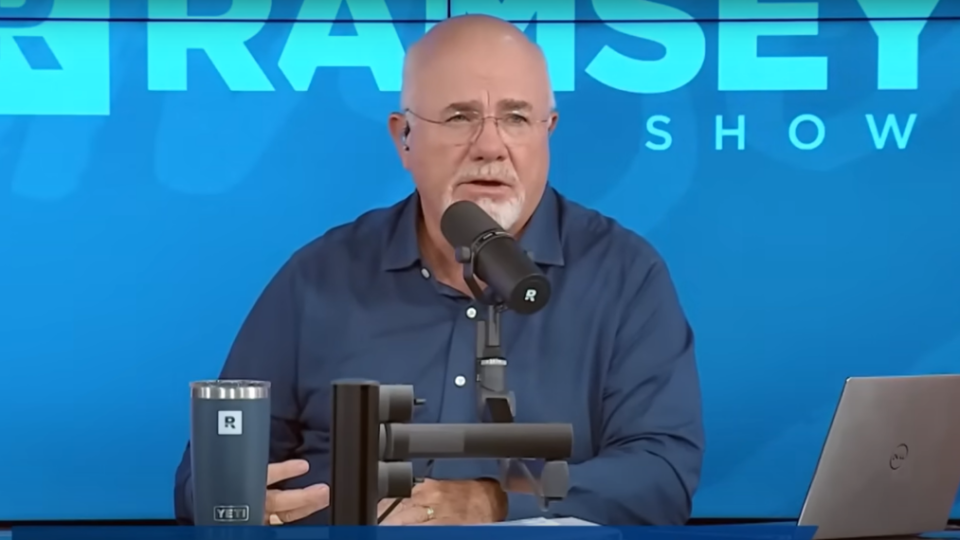

In an October episode of the “The Ramsey Show”, a caller from Washington D.C., highlighted a common financial challenge faced in urban areas. Earning around $90,000 annually and with significant savings, the caller was spending about $2,000 a month on rent in downtown D.C. Despite this considerable expense, they managed to save and minimize other costs.

Show host Dave Ramsey responded, emphasizing his financial guidelines. “We tell folks to put 25% of their take-home pay aside for housing, and no math works in every city and in every state you don’t get a pass on math because you’re in Washington D.C.”

This advice reflects Ramsey’s broader philosophy that staying within the 25% limit prevents people from becoming house poor, ensuring they can comfortably manage other expenses without relying on debt.

Don’t Miss:

Ramsey’s advice, however, is somewhat more conservative than the general guideline recommended by many experts and government agencies. The commonly accepted rule of thumb is that housing costs should not exceed 30% of one’s gross income. This broader perspective encompasses rent or mortgage payments, homeowner association fees and utilities like gas, electricity, water and internet. The U.S. Department of Housing and Urban Development defines affordable housing as costing no more than 30% of a household’s income.

Despite these recommendations, the reality for many Americans is different. Data indicates that a significant proportion of American renters and homeowners spend more than the recommended percentages on housing.

In 2020, 46% of American renters were spending 30% or more of their income on housing, and 23% were allocating at least 50% of their income to it. Similarly, data from 2017 to 2021 showed that 31% of households spent 30% or more of their income on housing. The average American household spends approximately 35% of its after-tax income on housing, which is above both Ramsey’s and the general 30% guideline.

In total, 31.8% of all U.S. households (40.6 million homeowners and renters) were cost-burdened in 2021. This figure includes nearly 1 in 6 U.S. households (20.3 million) that spent over half of their income on housing. For low-income households, such high-cost burdens significantly limit their ability to afford other necessities like food and healthcare.

The variation in these guidelines and the reality of housing expenses reflect the complexity of personal finance. While Ramsey’s 25% rule aims to provide a conservative framework for financial stability, the general 30% guideline offers a slightly more flexible approach.

Actual spending patterns suggest that many households struggle to keep housing costs within these limits, often because of high living costs in urban areas, limited affordable housing options and varying income levels. This highlights the need for personalized financial planning that takes into account individual circumstances, local housing markets and overall financial goals.

For people struggling with high housing costs, fractional real estate investing offers an innovative solution. Some investing platforms even allow individuals to invest in real estate with as little as $100. Investors get a share of the rental income and long-term appreciation without the direct financial burden of buying a property themselves.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

This article Dave Ramsey Says It Doesn’t Matter Where You Live — The Same Budget Rule Applies: ‘Math Works In Every City And Every State. You Don’t Get A Pass On Math Because You Live In Washington D.C.’ originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Source: finance.yahoo.com