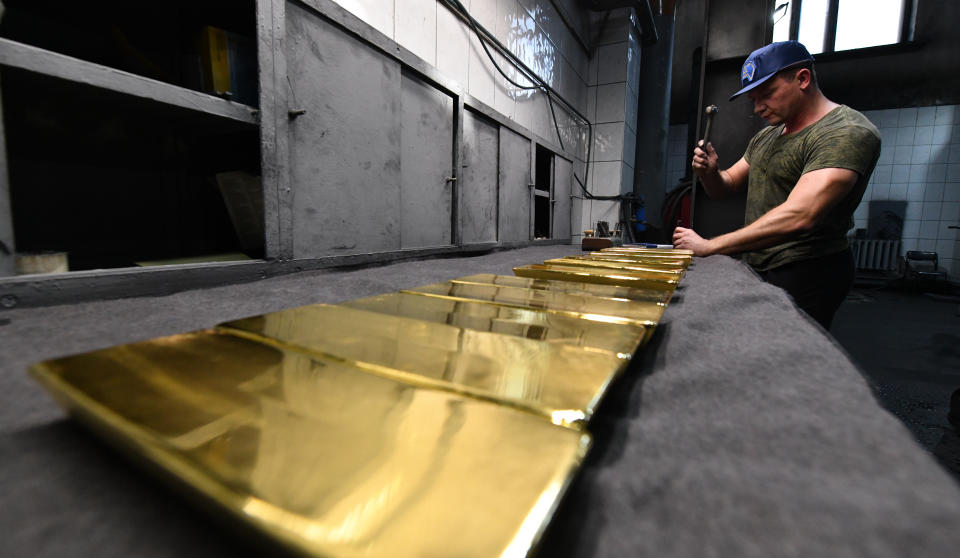

Gold futures (GC=F) hit their highest level since July on Wednesday as geopolitical conflict has intensified in the Middle East.

The precious metal has often been considered a safe-haven asset for investors in times of conflict and uncertainty. Its most recent spikes were an all-time high during the pandemic-driven market turmoil in spring 2020 and at the onset of the Russia-Ukraine conflict in early 2022.

“Gold should have some near-term momentum as geopolitical tensions in the Middle East persist,” DataTrek co-founder Jessica Rabe wrote in a note on Monday.

But there’s skepticism over how much higher the asset can go. Lee Munson, the chief investment officer at Portfolio Wealth Advisors, has long been a self-proclaimed buyer of gold.

“It used to be my baby,” Munson told Yahoo Finance. “But now is not the time to buy gold.”

Gold, like bonds, is seen as a “flight to safety” asset. So amid growing geopolitical tensions and an uncertain macro environment that could end in a recession, investors would typically flock to gold.

But Munson says the current high-rate environment makes gold unattractive. Yields on Treasurys are paying their highest rates since 2007, meaning investors can earn roughly 5% in that flight to safety trade.

Gold is a trade for when “real” interest rates — or those adjusted for inflation — are negative, per Munson, and that’s not the current environment. As Yahoo Finance’s Jared Blikre has recently pointed out, real interest rates are currently positive and could get even higher if the Fed doesn’t hike rates further and inflation falls.

“When you have rates like this, gold becomes very uninteresting. It just does,” Munson said. “Because I want money. I want cash flow.”

Simply put, there’s an “opportunity cost” to owning gold at its current levels, per Munson, meaning that money in gold can’t be spent elsewhere. This could become more costly if the Fed hikes rates further and inflation accelerates as that would likely send stocks lower and yields higher, according to Munson.

And when that happens, gold investors will want to reallocate.

“They’re going to sell all the gold to buy stock,” Munson said. “They’re going sell all their gold to buy 5- and … 30-year [Treasurys].”

Josh Schafer is a reporter for Yahoo Finance.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Source: finance.yahoo.com