The U.S. government has announced a proposed $7 billion (for starters) on desperately needed breakthroughs in clean hydrogen production.

The Department of Energy’s (DoE) biggest bet is on nuclear power plants, which they are hoping to convert into North America’s premier clean hydrogen producers.

Those billions of dollars are being poured into technological innovation, lowering costs and scaling up the production of clean hydrogen, including through the use of nuclear power plants in New York, Ohio, Minnesota and Arizona.

For now, the majority of hydrogen in the United States is produced by natural gas reforming in large central plants—an important step in the energy transition. The end goal, however, is to produce hydrogen without creating carbon emissions, and that’s what the federal government’s $ 7 billion spend is all about.

At four nuclear plants across the country, scientists are trying to perfect a process called “electrolysis” to create pure, clean hydrogen. The process involves splitting water into pure hydrogen and oxygen using high temperature electrolyzers. For now, however, the process is prohibitively expensive and energy intensive.

That could make this recent breakthrough all the more significant …

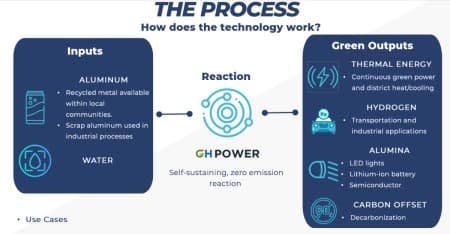

GH Power has developed a unique renewable energy technology that uses exothermic reactions to create three highly sought-after green outputs: hydrogen, alumina (aluminum oxide) and exothermic heat, killing three birds with one high-tech stone.

The hydrogen produced by the modular version of GH Power’s 2MW reactor is pure and clean, with zero emissions, zero carbon and zero waste, using only 2 inputs (recycled aluminum and water).

GH Power has been developing the new type of reaction for hydrogen production over the past 7 years, and now it’s gearing up to flip the switch on the first commercial reactor of its kind in Hamilton Ontario, Canada.

Flipping the switch on this new reactor comes at a critical juncture in the global energy transition. The Hydrogen Council estimates that hydrogen will represent 18% of all energy delivered to end users by 2050, avoiding 6 gigatonnes of carbon emissions annually and turning around an approximated $2.5 trillion in annual sales (not to mention creating 30 million jobs globally).

VISUALIZING A FUTURE POWERED BY CLEAN HYDROGEN

GH Power’s reactor is self-sustaining, zero emission and is a net producer of energy for consumption. It’s 100% clean and modular, which means it can be assembled on site to power North America’s industries for the first time with clean energy and cost competitive with conventional fossil fuels.

It also produces green hydrogen, exothermic heat, as well as highly valuable green alumina, which has numerous commercial applications used for everything from lithium-ion batteries and LED lighting to semiconductor production.

The GH Power process is proprietary and breakthrough:

GH Power is planning to develop a plant which produces 11,700 Tonnes of green hydrogen per year to fuel 30 MW combined cycle plant with a net output of 27 MW.

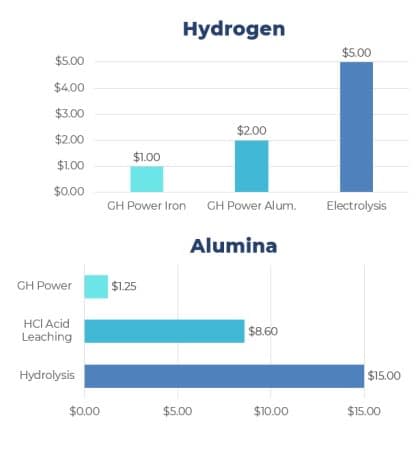

For now, the DoE puts the cost of producing hydrogen from renewable energy at about $5 per kilogram, which is about 3X higher than the price of producing hydrogen from natural gas. The DoE’s goal is to see clean hydrogen production costs decline by 80% to $1 per kilogram in a decade.

By the company’s estimates, GH Power’s reactor is already 60% cheaper than producing hydrogen by electrolysis, and it is a net producer of electricity to the grid. Its green alumina co-product production costs are also over 85% cheaper than the most commonly used processes currently used for alumina production that rely on hydrochloric acid leaching and hydrolysis for alumina production. This could be a game changer in the decarbonization of the critical sector.

Finally, GH Power’s base 27MW net output plant design is forecast to produce a carbon offset of 1.2 million tonnes annually (based on displacing a coal-fired plant the same size)

The company has also had successful tests using scrap steel (iron) as another metal fuel for hydrogen generation. The use of recycled metals provides a scalable solution with a much lower costs basis at under a $1/kg hydrogen. Scrap iron is the most widely available metal fuel in most markets.

Not only is this a cost breakthrough, but it is a proprietary technology that embraces the idea of a circular economy with zero emissions.

The process uses recycled scrap aluminum as the key input. That aluminum is then mixed with water through a proprietary reactor designed to continuously operate to produce hydrogen, alumina and exothermic heat (power) with zero emissions.

Scrap or recycled aluminum is widely available in almost every market, and can be found for as little as $1.50/kg.

It’s a new technology that can run full circle from using recyclable materials to help other companies, organizations, and industries to meet their own net-zero commitments. And it’s all modular and brings the energy to within the last mile of the energy user. For hydrogen, it could be a huge competitive advantage to be able to build a plant right where it’s needed, without massive hydrogen storage facilities and without transportation needs.

FLIPPING THE SWITCH ON THE FIRST REACTOR

GH Power and its team of engineers have already completed Phase 1 testing of their 2MW reactor in Hamilton, Ontario, and Phase 2 testing began on June 30th.

Next step is to move into commercial operations and 24-hour continuous operations.

Revenue generation is forecast to begin in the fourth quarter, and then the future is all about scaling up from 2MW reactors to a 27MW Net Output power solution.

The scaled-up 27 Net Output MW version of this reactor, planned for the near future, will produce the same three green outputs which can be blended with natural gas in a turbine. This could allow GH Power’s solution to integrate with existing natural gas power plants and allow companies to utilize existing assets while making a serious reduction in CO2 emissions.

The world needs 520 million tonnes of hydrogen to achieve net-zero targets by 2050, according to the International Energy Agency (IEA). Given the current state of advancement with electrolysis for producing hydrogen and the associated costs, we won’t make that goal without alternative breakthroughs such as GH Power’s. And because this new reactor aims to produce three green outputs, the contributions to zero-emissions goals should be compounded far beyond the individual numbers.

This award-winning technology is the result of seven years of painstaking research by world-class scientists and engineers, led by GH Power CEO Dave White, a veteran engineer in the power generation space. Combined, the GH Power team has, has well over a century of power generation experience in the design, build and operation of power plants, refineries, and other energy infrastructure.

Chief Engineer Ken Stewart has been designing and managing thermal power plant and petrochemical processes for over four decades and across eight different power plants in North America. COO Gary Grahn brings to the table 25 years of international energy experience, including in oil, gas, minerals, metals and utilities, and CFO Anand Patel contributes a decade of real asset capital markets experience, with over $4 billion in completed transactions, including for renewable energy giant Brookfield Asset Management. Finally, project development director Mike Miller offers more than 35 years of experience infrastructure, private equity and development for top companies along the energy supply chain, such as giant NextEra Energy.

GH Power has been working closely with Carleton University and is the recipient of a $2.2-million grant from a joint German-Canadian government program as part of Canada’s alliance with Germany to bolster its hydrogen strategy. It’s a feather in Canada’s cap as the country seeks to become a top global supplier of clean hydrogen with a transatlantic supply chain.

The idea itself is in line with what world-renowned physicist Neil de Grasse Tyson calls the ‘cosmic perspective.’ Large-scale green hydrogen projects in existence today are only as clean as the energy required to produce them and only as plausible as the cost required to get to the end game. “The only practical solution for society to reduce carbon emissions is to transition from 100% fossil fuels to cleaner tech,” and one of the steps in tackling this is to blend cost-competitive green hydrogen with fossil fuels and ramp up the hydrogen content whenever possible,” noted Dave White, GH Power CEO.

Ballard Power Systems Inc. (NASDAQ:BLDP) has firmly established its presence in the vanguard of the fuel cell revolution. Their pioneering proton exchange membrane (PEM) technology is powering various transportation sectors, ranging from buses to trains. This makes Ballard not just a producer, but an influencer, guiding the green transit narrative globally.

For investors, the scope of Ballard’s influence translates into potential growth. With the increasing emphasis on sustainable energy and cleaner modes of transportation, Ballard’s technology is likely to see an uptick in demand.

The broader vision of Ballard is shaping the industry’s future trajectory. Investors looking to align with a forward-looking company would find Ballard’s approach and ethos resonating with global sustainability goals.

FuelCell Energy Inc. (NASDAQ:FCEL) stands out as a force of change in the stationary fuel cell power plant market. Their focus on distributed power generation means they’re addressing the critical need for decentralized, efficient energy sources.

Their products are engineered with a balance of commercial viability and environmental responsibility. This dual approach makes their solutions attractive in a market that demands both profitability and sustainability.

For investors, FuelCell Energy presents an opportunity that’s grounded in present needs and future potential. Their dedication to curbing emissions while improving energy efficiency aligns with global shifts, promising potential returns and impact.

Bloom Energy Corporation (NYSE:BE) is redefining the fuel cell landscape with their innovative solid oxide fuel cells. Designed for on-site electricity generation, their products aim to tackle inefficiencies associated with centralized energy distribution.

This vision of decentralized power generation is crucial in an era where energy security and efficiency are paramount. By providing businesses and communities control over their power sources, Bloom offers a solution that’s both innovative and timely.

Bloom represents more than just a tech company. It’s a glimpse into the future of energy. Their relentless focus on technological advancement and market responsiveness makes them a promising contender in the renewable energy sector.

Plug Power Inc. (NASDAQ:PLUG) innovative hydrogen fuel cell systems are carving a new path in the green energy sector. Their solutions, aimed at replacing conventional batteries, mark a transformative shift in energy storage and application.

Their ambition reaches beyond mere product development. With a mission to redesign the energy value chain, they’re reimagining how industries approach power and sustainability. This comprehensive vision indicates a long-term strategic plan, appealing to forward-thinking investors.

The commitment Plug Power demonstrates toward a sustainable energy future makes it a critical player in the hydrogen space. As industries transition, investors can anticipate a rising demand for Plug Power’s trailblazing solutions.

Air Products and Chemicals, Inc. (NYSE:APD) isn’t new to the industrial gas scene. Yet, their dive into the hydrogen sector is indicative of their ability to innovate and adapt. By creating integrated hydrogen systems, they’re looking at the bigger picture of a sustainable energy ecosystem.

Their vast experience gives them an edge. Not many companies can claim expertise in both production and distribution. With hydrogen poised to be a key player in future energy scenarios, their end-to-end solutions offer reliability and scalability.

Air Products and Chemicals presents a compelling narrative in the hydrogen story. Backing a company with both heritage and foresight can be a lucrative move, especially when the global momentum is tilting towards hydrogen.

Linde plc (NYSE:LIN), with its extensive history in the industrial gas domain, is making commendable strides in the hydrogen space. Their approach is holistic, focusing on every aspect from production to infrastructure, underscoring a commitment that feels both deep and genuine.

Their existing global footprint offers them an advantage. They’re not just producing hydrogen; they’re setting up infrastructure, partnering on projects, and engaging in R&D to push the envelope further.

Linde offers stability and innovation in equal measure for investors. Their vast experience combined with a proactive approach to the hydrogen revolution paints a picture of steady growth and visionary leadership.

Cummins Inc. (NYSE:CMI) might be renowned for its engines and power solutions, but its foray into hydrogen showcases adaptability and vision. They’re not just adding a new product line; they’re rethinking the future of transportation and power.

Their blended approach is their strength. By marrying their traditional product offerings with innovative hydrogen solutions, they’re setting themselves up as a one-stop-shop for energy needs across the board.

Investors eyeing Cummins will see a legacy brand that’s refusing to rest on its laurels. Instead, Cummins is evolving, making it an attractive proposition for those looking for both stability and growth potential.

Shell’s (NYSE:SHEL) transition narrative is both fascinating and instructive. Moving from a traditional oil major to a diversified energy company, their hydrogen initiatives reflect a broader shift towards sustainability and innovation.

Their projects in the hydrogen domain, from refueling stations to research collaborations, indicate a comprehensive and future-ready strategy. Shell’s pivot towards hydrogen is not an afterthought; it’s an integral part of their future roadmap.

For investors, Shell offers a dual advantage. The stability and robustness of an established energy giant, combined with the agility and foresight of a green tech firm, make it an enticing option in a volatile energy market.

BP’s (NYSE:BP) rebranding from ‘British Petroleum’ to ‘Beyond Petroleum’ is symbolic of its evolution. Once a stalwart of the traditional energy sector, it’s now championing the green energy revolution, with hydrogen being a key focus.

Their endeavors in hydrogen, be it through investments or partnerships, showcase a progressive mindset. By positioning hydrogen as a cornerstone of their future growth strategy, they’re aligning with global sustainability goals.

Investors considering BP are not just looking at an energy company; they’re looking at a future-focused entity that’s reinventing itself. Their commitment to hydrogen signals long-term growth potential and a readiness to shape the energy landscape of tomorrow.

By. James Stafford

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the US government is funding development of hydrogen technologies; that billions of dollars are being invested in clean hydrogen producers; that governments are aiming to help develop carbon-free clean hydrogen solutions; that nuclear power plants are being utilized to perfect electrolysis for creation of pure, clean hydrogen; that hydrogen power will be utilized as a main source of energy for the global economy in the future and replace fossil fuels and other competing alternative technologies in the future; that GH Power Inc.’s technology will be developed, commercially implemented and achieve widespread market acceptance; that GH Power will complete the development of a hydrogen reactor that will produce hydrogen 60% cheaper than by electrolysis, become a net producer of energy to the supply grid, co-produce alumina which is 85% cheaper than current production methods; that GH Power’s technology will be revolutionary in the decarbonization of the energy sector; that GH Power’s small pilot model will be scalable at the commercial level in the proposed reactor in Hamilton, Ontario, and will achieve the anticipated results of clean, carbon-free energy production and related bi-products; that GH Power can finance ongoing operations and development; that GH Power can achieve its business plans and objectives as anticipated. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition including that government may fund the development of alternative technologies instead of hydrogen based technologies; that hydrogen technology may fail to gain commercial acceptance due to safety, cost or other issues; that alternative technologies are preferred in the future to hydrogen technologies as the main replacement of fossil fuels and other energy sources; that GH Power Inc.’s technology may fail to be completely or successfully developed and commercially implemented; that alternative technologies may gain wider acceptance than those of GH Power for various reasons; that alternative technologies may result in greater energy savings and necessary bi-products; that GH Power’s technology may fail to deliver the results anticipated in a commercial setting; that GH Power’s reactor may not be developed as anticipated or at all; that GH Power may be unable to finance its ongoing operations and development; that the business of GH Power may be unsuccessful for various reasons. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by GH Power Inc. for this article but may in the future be compensated to conduct investor awareness advertising and marketing for GH Power Inc. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct. The content of this article is based solely on our opinions which are based on very limited analysis and we are not professional analysts or advisors.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of GH Power Inc. and therefore has an incentive to see the featured company perform well if its securities becomes listed on a stock exchange. If the securities of GH Power become listed on a stock exchange, the owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of GH Power Inc. in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we are biased in our views and opinions in this article and why we stress that you should conduct your own extensive due diligence regarding the Company as well as seek the advice of your professional financial advisor or a registered broker-dealer before you consider investing in any securities of the company or otherwise.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making any investment. This communication should not be used as a basis for making any investment in any securities.

RISK OF INVESTING. Investing is inherently risky. Don’t invest or trade with money you can’t afford to lose. This is neither a solicitation nor an offer to invest or buy/sell securities. No representation is being made that any stock investment, acquisition or disposition will or is likely to achieve profits.

Read this article on OilPrice.com

Source: finance.yahoo.com