-

The average American millennial is better off financially than they were five years ago.

-

Higher salaries have allowed many to grow their wealth and buy homes.

-

Under the weight of student debt and childcare, they may still be worse off than prior generations.

This story is kicking off a series called “Millennial World,” which looks at the state of the generation around the globe.

Millennials are growing up.

The oldest of the generation, which includes anyone born between 1981 and 1996, is now past the age of 40. In recent years, many have checked off major life milestones including buying a home and having children, and some could even be on the verge of a midlife crisis.

But getting older has already come with some growing pains.

Over the past decade — and longer for some — many millennials have faced high costs of housing and childcare, staggering student-loan debt, and the Great Recession’s impact on the job market. This trifecta hit older millennials the hardest and continues to have lingering effects.

Despite these obstacles, the average millennial is faring better financially than they have in the past. And while some of this may simply be a byproduct of getting older — people tend to earn more over the course of their careers — some experts have argued that even compared to past generations, millennials are doing pretty well financially these days.

From saving to spending and financial behaviors in between, here’s what life is like for the average American millennial.

Editor’s note, May 30, 2023: This story was updated to clarify household income versus individual income data.

The typical US millennial makes between about $52,000 and $62,000 a year.

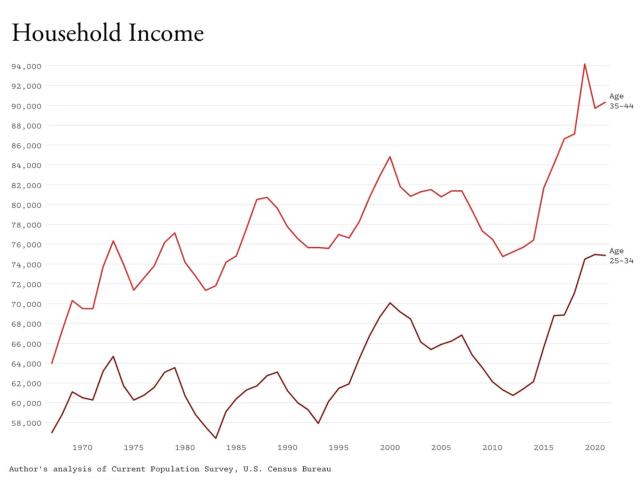

The Great Recession took a financial toll on millennials and their salaries. By 2014, the median household income of millennials aged 25 to 34 had fallen by more than 10% since 2000 when adjusted for inflation, according to Census Bureau data.

But things have improved in recent years. By 2019, the same age group had a median household income of $70,283. By 2021, it was $74,862.

Older millennials have seen income gains as well. The median household income for millennials aged 35 to 44 has risen from $66,693 in 2014 to $90,312 in 2021.

This growth holds up well when adjusted for inflation — even compared to past generations. As of 2019, the median millennial household income, when adjusted for inflation, was roughly $10,000 higher than those of median Gen X and boomer households at the same age, according to the Current Population Survey.

According to a SmartAsset analysis of data from the Bureau of Labor Statistics from the third quarter of last year, the median salary of an individual US adult aged 25 to 34 is $52,156. The median salary of an adult aged 35 to 44 is $62,444. At this point, millennials will be anywhere from 26 to 42 years old.

American millennials’ average net worth has grown considerably in recent years and now sits at about $127,793.

The average US millennial’s net worth more than doubled between the first quarter of 2020 to $127,793 as of the first quarter of 2022, according to a MagnifyMoney analysis of Federal Reserve data.

Older millennials appear to be driving the gains. A December Forbes analysis of Federal Reserve data found that the average net worth of Americans under age 35 was $76,300, compared to $436,200 for those aged 35 to 44.

It’s taken some time for millennials to catch up to prior generations when it comes to wealth. A Federal Reserve Bank of St. Louis analysis of 2016 data found that the families of older millennials had a median wealth about 34% percent lower than people of prior generations at the same age. But by the time 2019 data was available, the gap had shrunk to 11%. More recently, a St. Louis Fed’s analysis of 2022 data found that “young Americans” — a group with an average age of 33 to 34 — had roughly the same average wealth adjusted for inflation as Gen X did at the same age.

The fact that some millennials may be doing just as well — but not a lick better — than older generations arguably isn’t worthy of much celebration in a country where parents want their children’s lives to be better than their own. But at least they no longer appear to be trailing so far behind.

Almost half of millennials have student-loan debt and are, on average, $40,614 in the hole.

In 2020, Insider reported that nearly 45% of millennials had student-loan debt.

As of June 2022, 43.5% of older millennials aged 36 to 41 had a student-debt balance of $20,000 or less, according to the St. Louis Fed. The average millennial with student debt had a balance of $40,614, according to an Experian analysis of internal data.

While the cost of college has been one of millennials’ key financial obstacles, those with federal student debt could be set to have up to $20,000 of their debt canceled as part of a Biden administration plan. Currently, the debt-relief proposal is paused due to two conservative-backed lawsuits that blocked the implementation of the relief in November, and borrowers are awaiting a Supreme Court decision on the legality of the relief, expected by the end of June.

A Morning Consult and Politico poll of over 2,000 registered voters last June found that 65% of respondents aged 18 to 34 supported Biden forgiving $10,000 per borrower; 61% of respondents aged 35 to 44 thought the same.

More than half of millennials have now managed to buy a home.

Millennials crossed a notable threshold in 2022. By the end of the year, a majority of them — about 51.5% — owned a home, a RentCafe report that analyzed housing data from the Current Population Survey for each generation across 260 US metro areas found.

The average millennial was 34 years old when the generation reached this milestone. Gen X and Boomers were 32 and 33 years old respectively when their generations became majority owners.

The millennial generation has been on a homebuying spree in recent years. Seven million of the 10.8 million new millennial homeowners gained over the past decade bought their homes over the past five years, RentCafe reported.

Low interest rates provided a great buying opportunity for many millennials during the early days of the pandemic. But the Federal Reserve has since raised rates to combat inflation, leaving millennials that didn’t jump in on the homebuying spree with a much more challenging landscape today.

In July 2020, the typical annual US mortgage payment was 27.5% of the median American’s household income — the lowest figure since 2013 — according to the Atlanta Fed.

As of last September, this figure rose to 43.7%, the highest level since at least 2006, when the Fed’s data begins. As of March, the median annual mortgage payment was 39.9% of the median household income.

The typical millennial is a parent but has been slower than past generations to grow their families.

While many millennials have managed to buy a home, they have been slow to fill them up with children. As of 2018, 55% of surveyed 22- to 37-year-old millennial women had given birth to a child, according to a Pew Research survey that spanned both Gen Z and millennials, compared to 62% of Gen X and 64% of boomers at the same age.

After hitting a record low in 2020, the US birth rate rose for the first time in seven years in 2021, but it remained near the record low reached the year prior. The birth rate was reported as 1.66 births per woman, a decline from 2.12 in 2007, and the rate of 2.1 needed for the population to naturally replace itself.

There’s evidence that many millennials are open to having more children, but haven’t ultimately done so due to a variety of factors. One could be the high childcare costs many millennial parents face.

National childcare costs average between $9,000 and $9,600 annually, per the advocacy organization Child Care Aware, a rate that’s unaffordable for nearly two-thirds of working parents in the US — and the cost could shoot even higher over the next year as federal funds dry up.

Read the original article on Business Insider

Source: finance.yahoo.com