With U.S. Treasury and corporate bond yields rising, American investors have more options outside the equity market than they have for years, just as stocks are near their most “expensive” on a historical basis. It’s a combination that will result in U.S. households selling $750 billion worth of their stock holdings in 2023 as a new era for markets begins, according to David J. Kostin, Goldman Sachs chief U.S. equity strategist.

For years after the Great Recession of 2008, many investors lived by a mantra called “TINA”—or “there is no alternative” to stocks. The idea being that with interest rates near zero, savings accounts, U.S. Treasuries, and corporate bonds weren’t offering attractive returns, so the stock market was the only option.

But when the Federal Reserve began aggressively raising interest rates in March 2022 in order to fight the rise of inflation, a new era began. “TINA” is now “TARA”—or “there are reasonable alternatives”— Kostin argues, pointing to bonds and treasuries as new viable options for investors.

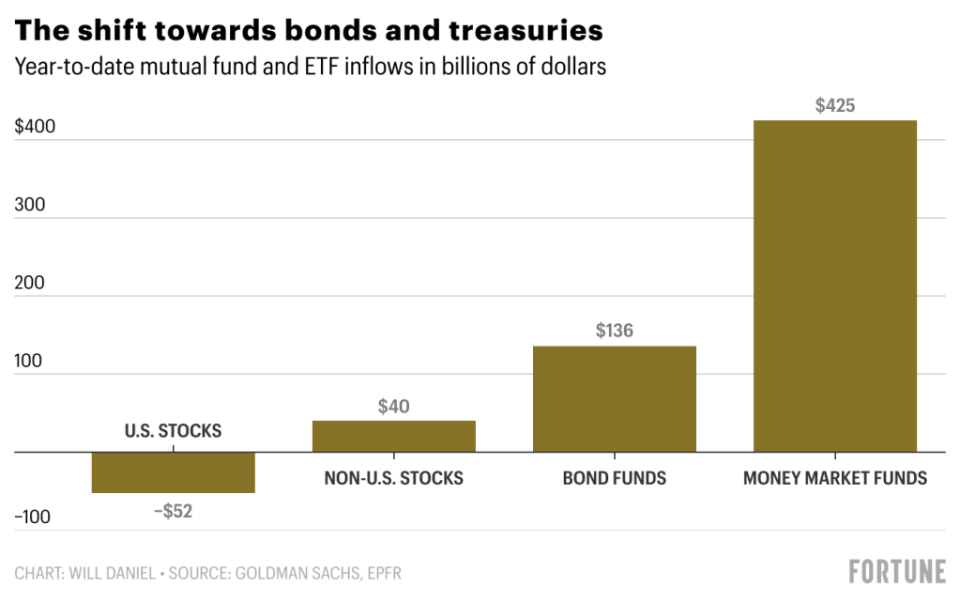

“[F]lows into money market and bond funds signal an escalating household shift away from equities and toward the alternatives,” he wrote in a recent research note.

American households currently invest 40% of their financial assets into equities, but that’s changing. Even before March’s string of bank failures sent financial stocks tumbling, rising interest rates were driving many investors, particularly more conservative ones, away from equity markets.

Household equity demand, adjusted for hedge fund buying, fell 78% year over year to just $209 billion in 2022, according to data from Goldman Sachs and the Federal Reserve. And investors pulled $52 billion from U.S. equity ETFs and mutual funds through March 23 while piling $425 billion into money market funds that invest in short-term debt like U.S. Treasury bills over the same period. Kostin said the data “reflected an increasing investor preference for lower-risk, yield-bearing assets.”

He’s not the only one making the argument that investors’ stock obsession is coming to an end. Brendan Murphy, head of Core Fixed Income, North America at Insight Investment, told Fortune earlier this year that TINA justified a “shift into riskier assets” and “became embedded in investor psychology” after the Great Recession.

“It may take time for markets to readjust to a world where lower-risk assets provide meaningful returns, but as they do, flows should follow,” he said, adding that there will be a “gradual reallocation from higher-risk to lower-risk assets in the years ahead.”

Analysts have described the coming migration away from stocks as everything from “TIARA”—”there is a realistic alternative”—to “TAPAS”—“there are plenty of alternatives,” but Goldman Sachs’ new data provides, for the first time, some insight into just how sizable that migration could be.

The investment bank’s strategists laid out a “downside case” for the U.S. stock market, where the yield on the 10-year treasury continues to rise and consumers dramatically increase their savings rate, leading even more money to be pulled from stocks. If that happens, U.S. households could sell up to $1.1 trillion in stock this year. For comparison, at the end of 2022, total U.S. equity ownership was $65 trillion.

This story was originally featured on Fortune.com

More from Fortune:

Source: finance.yahoo.com