Charmagne Chi enjoys early retirement so much, she has to remind herself to take days off.

More from Fortune:

If that sounds counterintuitive, it’s probably because Chi’s life now, two years into retiring from her 9-to-5 banking job 42, doesn’t reflect the image conjured in some people’s minds when they picture retiring early.

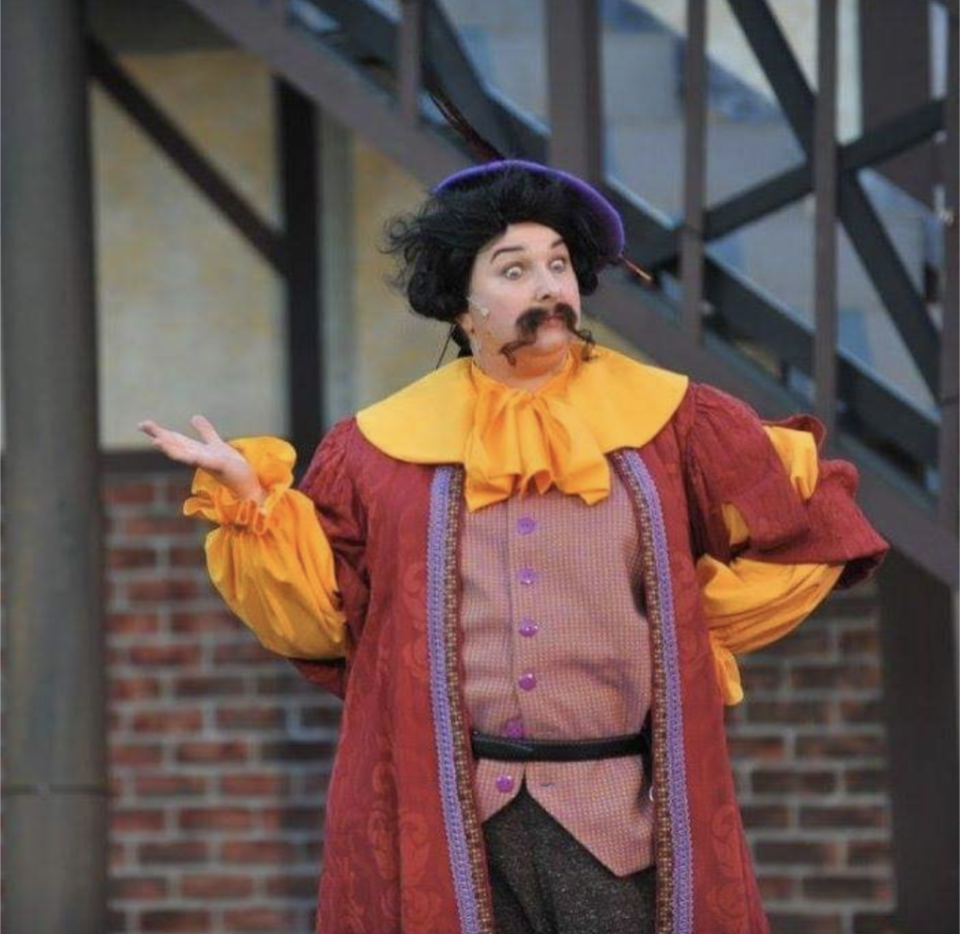

Chi doesn’t spend her days lounging on the beach, traveling the world, or blogging about early retirement (though she does post updates on TikTok). Instead, she works part-time for a local theater company in her hometown of Buffalo, New York, and practices writing and other creative pursuits. Her husband, who also left his IT job two years ago, spends his time weight lifting, volunteering with the local search and rescue team, and fostering dogs.

“Now that my whole life is only stuff I want to do, taking time off is very tricky,” Chi tells Fortune. “Every day feels like, ‘well, I’m only doing fun stuff,’ but then six weeks will go by and I’m exhausted.”

And so the 44-year-old is busier than ever. But you need not feel bad for her. That was always the point of trying to save as much as possible in her 30s, Chi says: It’s not that she didn’t want to work, per se. She wanted to be able to spend her days pursuing her passions, without worrying about finances. Some people might say that doesn’t really count as early retirement, but Chi doesn’t need the money she earns from the theater. She’s free to do whatever she wants with her time.

“When you don’t have to spend 40, 50, 60 hours a week earning a paycheck, whatever you would fill that time with, that’s the reason to retire early,” she says. “All I want to do is creative stuff all day, every day, and that’s what I’m doing.”

Chi declined to say exactly how much the couple saved before they decided to leave their jobs, but she did say that so called leanFIRE—in which someone aims for $1 million in savings before retiring—”was not enough” for her and her husband to feel comfortable taking the plunge.

‘Question everything’

Chi first came across the concept of early retirement on popular blogs like Mr. Money Mustache; she and her husband adapted the often extreme austerity practices of the Financial Independence, Retire Early (FIRE) crowd to fit their own needs and values.

Chi was refreshingly candid about how she and her husband were able to retire decades earlier than some. Of course, the couple implemented a number of the tried-and-true early retirement money-saving strategies. They drive one vehicle, maxed out their 401k and IRA retirement accounts every year‚ and cut superfluous spending. They did not have children, which she called “a huge savings.”

But all of that was possible, Chi says repeatedly, because of the privileges she and her husband have, especially their high-paying jobs while living in a relatively affordable city. They haven’t had any big medical issues, she says, and there are no other large expenses they have to account for. They do not have student loan debt.

“I’m a white, able-bodied person who was raised by middle class parents and didn’t have to pay for college,” she says. “Yes, there was a lifestyle component. But it’s not just ‘avoid avocado toast,’ that’s such bullshit.”

That said, while many similarly-privileged people feel like they must drive certain types of cars, live in specific cities, or use a particular brand of skincare, life doesn’t have to be that way, she says. That was a big mindset change Chi herself made a few years into her career.

Someone who bikes everywhere to save money like Mr. Money Mustache might be on the extreme end, but Chi says even realizing that not needing two cars was a possibility made her rethink how she was living. That led her to decide the family only really needed one car. That wouldn’t work for every single household and individual financial situation, but questioning standard consumption habits can be helpful for anyone looking to save a little bit of money.

“It made me question everything and examine every purchase and decision in a way I hadn’t before,” she says. Earlier in her career, she was buying the standard trappings of an upper-middle class: new clothes and expensive bags, getting her nails and hair done, seeing an aesthetician regularly. She cut most of that out when early retirement became her priority. “Those things didn’t make me any happier…I didn’t know I wanted to retire early, but I knew I was in a privileged position and I wanted to leverage that to be financially healthy.”

And none of this is to say that privilege kept Chi from being burnt out at her former job. She was experiencing chest pains from the stress; when she retired, she took six months to “aggressively rest” before diving into her passions full-time.

“I definitely had luck and privilege. But a lot of people have luck and privilege,” she says. “They could meet their goals and be a lot happier if they shifted their lifestyles.”

Living a ‘small’ life

Chi is often asked how her family would handle an emergency, medical or otherwise, that might necessitate one of them returning to work. Those kinds of questions don’t phase her though; one of them would simply find a job, she says. And a potential emergency expense is not a reason to not pursue a dream like early retirement.

“What if one of us had an illness…it can happen I guess. But it could happen to anyone,” she says, noting that she had a major surgery last year and it didn’t derail their retirement in the slightest; they buy health insurance through the New York state exchange, which works for them. “Any of those things that might happen to us might happen to anyone who planned on working their whole life and now can’t.”

Chi says she and her husband try to “live as small as humanly possible” so that they can minimize larger expenses, or at least prepare for them when they come along. They love living in Buffalo, which provides community and access to the arts at an affordable price. They plan to live in their home for the rest of their lives.

Living small is something she wishes more people in a similar financial position would try.

“Even an adjustment of 10% could give you enough fuck you money to leave a job you hate,” she says. “If you are in that privileged group, take a look and just do it.”

This story was originally featured on Fortune.com

More from Fortune:

Source: finance.yahoo.com