Easy monetary policy might seem fun at the beginning, but it has consequences.

While asset prices shot up in 2020 and 2021, they pulled back substantially in 2022. Meanwhile, inflation remains near 40-year highs and the Fed has to raise interest rates aggressively to bring price levels under control.

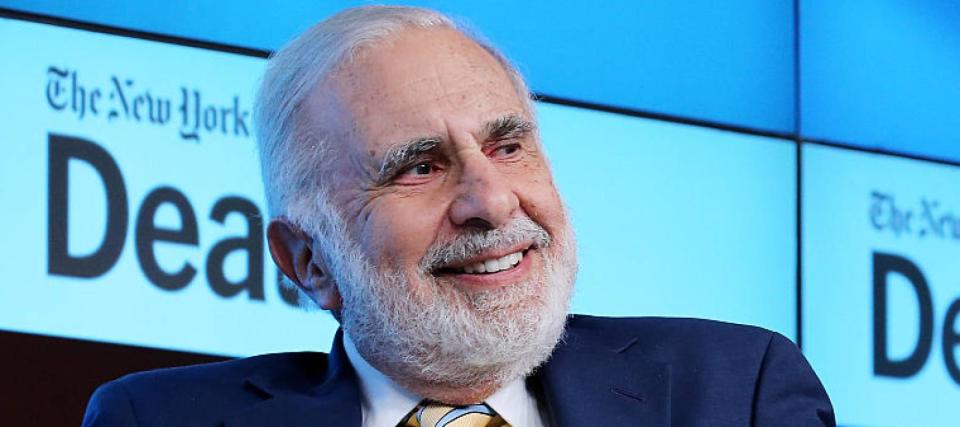

“We printed up too much money, and just thought the party would never end. And the party’s over,” Billionaire investor Carl Icahn says at MarketWatch’s Best New Ideas in Money Festival via a remote feed.

Still, although many investors suffered painful losses in 2022 — the S&P 500 had its worst first half of the year since 1970 — Icahn is not one of them. At his company Icahn Enterprises, the net asset value went up about 30% in the first six months of this year.

Looking ahead, his outlook isn’t exactly optimistic.

Don’t miss

“The worst is yet to come,” Icahn says, while cautioning that “inflation is a terrible thing” and “you can’t cure it.”

That said, he doesn’t suggest you should bail on stocks completely.

“I think a lot of things are cheap, and they’re going to get cheaper,” he says.

Given Icahn’s massively successful career as an investor, people want to know where he sees opportunity right now.

“I’m just curious what stocks look cheap and viable right now,” an audience member asked him during the Q&A session.

Icahn provided two names.

CVR Energy (CVI)

Energy was by far the S&P 500’s best-performing sector in 2021, returning a total of 53% vs the index’s 27% return. And that momentum has carried into 2022.

Year to date, the Energy Select Sector SPDR Fund (XLE) is up a solid 62%, in stark contrast to the broad market’s double-digit decline.

Icahn’s pick in the energy space is CVR Energy (CVI), which is mainly in the refinery business. He says that the stock “is quite cheap, even though it’s come up a lot.”

According to the latest 13F filing, Icahn held 71.2 million shares of CVR Energy at the end of September, worth approximately $2.06 billion at the time.

The position has servied the billionaire investor quite well as CVR Energy shares have surged 126% year to date.

As you’d expect from this kind of share price performance, the company is firing on all cylinders.

Read more: You’re probably overpaying when you shop online — get this free tool before Black Friday

In Q3 of 2022, CVR Energy brought in $2.7 billion of net sales, up from $1.9 billion in the year-ago period.

The business got more lucrative, too, as the refining margin per total throughput barrel improved to $16.56 in Q3, compared to $15.03 in the same period last year.

The company recently declared a special dividend of $1.00 per share — on top of its regular quarterly cash dividend of 40 cents per share.

Ichan also likes the business because “you can’t build another refinery in this country.”

CVR Partners LP (UAN)

CVR Partners is a master limited partnership created by CVR Energy to own, operate, and grow its nitrogen fertilizer business.

While the two entities are related — CVR Energy subsidiaries own 37% of the common units of CVR Partners — CVR Partners is also publicly traded. Its ticker symbol is UAN.

“[The] fertilizer business, to me, is a great business today,” Icahn says.

CVR Partners’ manufacturing facilities primarily produce ammonia and urea ammonium nitrate (UAN) fertilizers, and those things are in strong demand.

In Q3, the partnership’s average realized gate price for UAN shot up 42% year over year to $433 per ton. For ammonia, the average realized gate price rose 65% year over year to $837 per ton.

Unsurprisingly, CVR Partners has been another stellar performer in this ugly market as the stock is up 38% year to date.

It’s easy to see why the business is appealing to Icahn.

“You need fertilizer if you want to eat,” he says.

Indeed, if you want the ultimate hedge against all the uncertainties the world is facing today, agriculture deserves a serious look, even if you know nothing about farming.

What to read next

-

‘Imagine you are laid off’: Suze Orman’s 3 tough-love tips to prepare for the recession ahead

-

‘Not living their life to impress others’: Here are the top car brands that rich Americans earning more than $200K drive most — and why you should too

-

Morgan Stanley: Prices for Rolex, Patek Philippe and Audemars Piguet watches will keep plunging due to a flood of supply — but these 3 real assets remain scarce and coveted

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Source: finance.yahoo.com