The housing market is in something of its own recession as mortgage rates have surged. If the economist consensus is right about an existing home sales report due later in the morning, then sales will have fallen 28% from their peak.

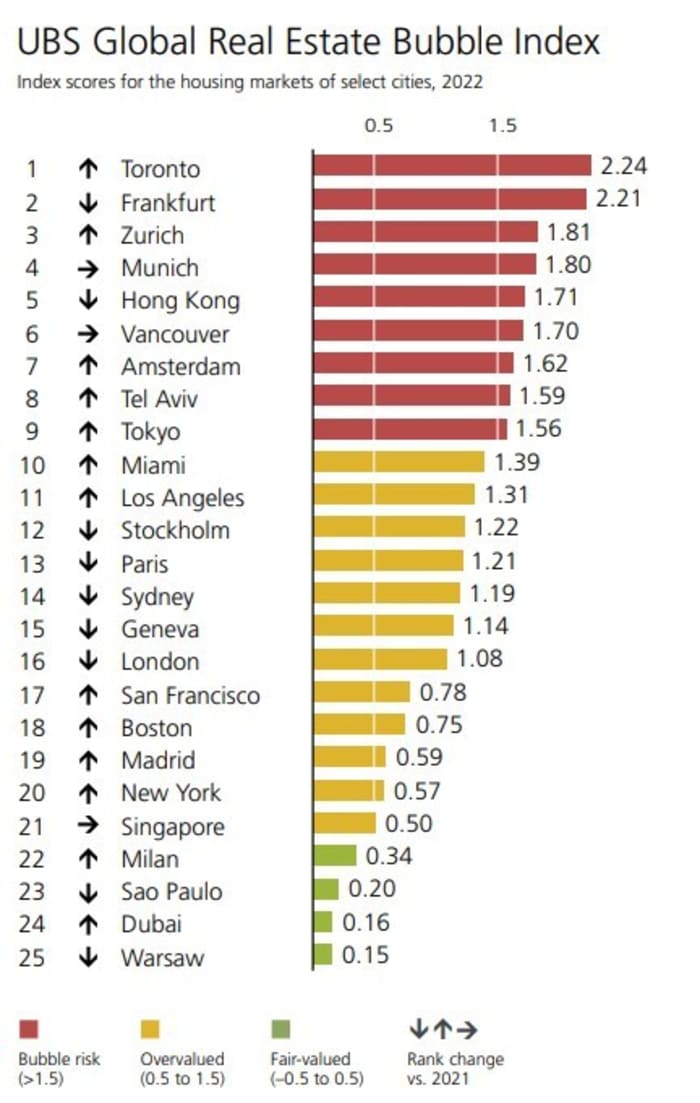

That’s why the arrival of the seventh annual UBS global real estate bubble report rings different, coming at the start of a period of retreat rather than during a wave of excess.

“The willingness to pay for owner-occupied homes is likely to take a hit. In cities with strong population growth, such an adjustment could manifest in the form of a prolonged stagnation in nominal purchase prices. But as real estate markets rarely trend sideways, this is not the most likely outcome,” says the report.

Since the UBS report is a global one, just five U.S. markets are analyzed: Miami, Los Angeles, San Francisco, Boston and New York. The bad news is, all five are overvalued. The good news is, none of the five is called a bubble risk. Save Miami, the other cities haven’t seen price growth as strong as the nationwide average, UBS points out. And income growth has been exceptionally strong, though strained affordability will likely start taking its toll, the report cautions.

Globally, the market that seems to be most in a bubble is Toronto, followed closely by Frankfurt, UBS says. Adjusted for inflation, price levels in Vancouver and Toronto have more than tripled in the last 25 years.

“In such overheated markets, with already very stretched housing affordability, the recent rate hikes by the Bank of Canada could be the last straw that broke the camel’s back. New buyers and owners during mortgage renegotiations not only need to pay higher interest rates but are also required to provide more income to qualify for a mortgage,” said UBS.

The UBS ranking is based on five factors: price to income, price to rent, the change in mortgage-to-GDP ratio, the change in construction-to-GDP ratio and the relative price of the city to the country.

The markets

U.S. stock futures ES00 NQ00 were beginning to creep off lows, even as Treasury yields rose and Tesla results disappointed. The yield on the 10-year Treasury BX:TMUBMUSD10Y reached the highest level since 2007. Crude-oil futures CL climbed to over $86 per barrel.

The buzz

U.K. Prime Minister Liz Truss abruptly resigned in the wake after financial market turbulence and a rebellion in her own Conservative Party.

Tesla TSLA slipped 6% in premarket trade after the electric car maker’s third quarter margin and revenue came in shy of estimates. The miss didn’t affect CEO Elon Musk’s confidence, who says there’s a path for Tesla’s valuation to exceed more than Apple and Saudi Aramco combined, as he also said a stock buyback of up to $10 billion was under consideration.

Musk also said he’s overpaying for Twitter TWTR but excited about the social-media service’s potential.

AT&T T shares rose after the telecom giant topped analyst earnings expectations.

Allstate ALL shares skidded after the insurer said it’s expecting a third-quarter loss, on catastrophe losses from Hurricane Ian as well as rising bodily injury and physical damage coverages. IBM IBM however rose after the technology giant upgraded its sales growth view for the year.

European telecom equipment makers Ericsson ERIC and Nokia NOK each slumped after their results.

Philip Morris PM raised its offer for Swedish Match SE:SWMA to $15.7 billion and separately agreed to pay $2.7 billion for U.S. rights to IQOS heated tobacco products from Altria MO.

Best of the web

China’s surveillance state is pushing deeper into their citizens’ lives.

Colleagues of an ABC News producer say they haven’t seen him since his home was raided by the FBI.

A deep dive into Florida Gov. Ron DeSantis, who could seek the Republican nomination for president if former President Donald Trump does not.

The chart

In his third-quarter shareholder letter, Bill Nygren of the Oakmark Funds produced this chart, showing the ratio of the 50th highest price to equity ratio in the S&P 500 to the 450th P-to-E. That dispersion is 40% wider than normal. “As has often been the case, unusually high volatility leads to a high spread in valuations, which has been—and we believe will be—a good environment to add value via stock picking,” he says.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| GME | GameStop |

| MULN | Mullen Automotive |

| AMC | AMC Entertainment |

| NIO | Nio |

| AAPL | Apple |

| BBBY | Bed Bath & Beyond |

| APE | AMC Entertainment preferred |

| NFLX | Netflix |

| CFMS | Conformis |

Random reads

A King Charles III watercolor goes under the hammer. An art critic: “It’s not great.”

A California bakery has created a life-sized Han Solo, out of bread.

A British man thinks he’s found the face of former, and perhaps future, Prime Minister Boris Johnson, in a curry.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

Source: finance.yahoo.com