Russian President Vladimir Putin’s invasion of Ukraine may seem like a remote conflict to Americans more concerned with troubles at home, and the stake we have in the conflict may be far smaller than that of Ukrainians who will suffer and die, but we’re going to feel the effects of Putin’s aggression nonetheless, most immediately in the form of high gasoline prices.

Russia was already affecting energy markets even ahead of Wednesday’s invasion, the worst security crisis Europe has faced since World War II. Brent crude oil on Thursday surged above $105 a barrel for the first time since 2014. (It fell to $99 on Friday.) If oil prices rise to $120 per barrel and gas prices remain elevated, inflation would rise by a full percentage point and slow economic growth this year, analysts at Berenberg bank say.

The invasion’s effect on gas prices, as well as prices and availability of aluminum and substances such as cobalt and nickel, poses risk to the auto industry, which has already struggled with the pandemic shortage of microprocessor chips.

President Biden addressed gas prices in his speech Thursday regarding the invasion. “We’re monitoring energy supplies for any disruption. We’re executing a plan in coordination with major oil-producing consumers and producers toward a collective investment to secure stability and global energy supplies. This will be — this will blunt gas prices. I want to limit the pain to the American people are feeling at the gas pump. This is critical to me.”

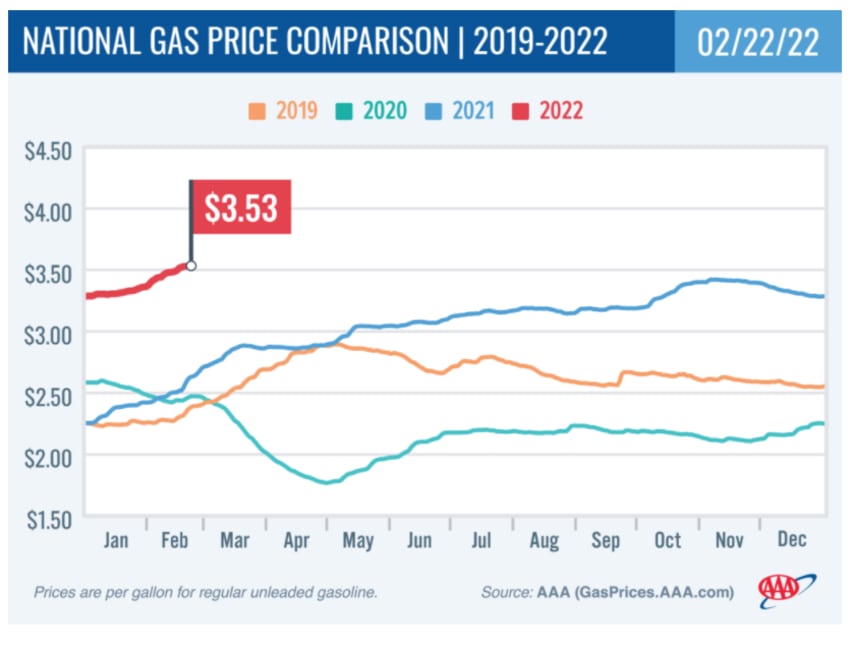

On Tuesday, the day before the invasion, AAA put the national average for a gallon of gas at $3.53, as shown on the chart below. As of Friday, the average price of gas had risen to $3.57. That’s up eight cents in a week, 25 cents in a month, and it’s almost $1 more than a year ago.

AAA’s reporting on Tuesday put the average price in the 10 costliest states at: California ($4.74), Hawaii ($4.51), Oregon ($3.98), Washington ($3.98), Nevada ($3.95), Alaska ($3.85), New York ($3.75), Pennsylvania ($3.73), Washington, D.C. ($3.72); and Arizona ($3.71).

President Biden and other Western leaders Thursday announced a wide range of sanctions against Putin, other individuals and Russia itself. The U.S. can expect retaliation for those sanctions in the form of Russia withholding oil from the world market. (Retribution may well also come in the form of cyberattacks against U.S. governments and businesses.) Russia is the world’s second-biggest oil exporter after Saudi Arabia and the third-biggest oil producer. Market supply was already tight and driving up prices.

“Russia is one of the leading oil producers globally, behind only the United States and Saudi Arabia,” said Andrew Gross, AAA spokesperson. “And if they choose to withhold their oil from the global market, such a move would eventually be reflected in higher gas prices for American drivers.”

Other energy costs

Russia is also the world’s top producer of natural gas, a lead that will only grow with control of Ukraine. Wars are often fought over natural resources, and that’s a key motive in Putin’s actions against resource-rich Ukraine. His control of its vast coal and gas reserves should have us concerned, both for immediate energy needs and in global efforts to mitigate climate change. Ukraine’s Donbas mining region will be key to Russia filling a contract to provide China with 100 million tons of coal, with another 40 million pledged to India.

The continent depends on Russia for more than a third of its gas supplies, and about a third of those flows are shipped via Ukraine. Low inventories of the fuel last year sent prices to record levels, and volumes from Russia have been curbed since the second half 2021.

Even as gunfire sounded in Ukraine’s capital, natural gas kept flowing normally Friday through the major pipelines from Russia to Europe. But the invasion and accompanying sanctions are casting a shadow over longstanding energy ties, both for the coming weeks and longer term.

Natural gas prices soared on news of the invasion. Prices fell sharply Friday after U.S. and European officials said sanctions against Russia would not interrupt energy supplies or, almost as important, payments through banks for shipments of oil and gas.

Supplies of liquefied natural gas brought by ship from the U.S. has helped relieve some of Europe’s gas shortage this winter, but it’s expensive, and export terminals are running at capacity.

European governments have rolled out cash subsidies for consumers hit by higher utility bills.

“The events of the last days show the imprudence of not having diversified our sources of energy and our providers in recent decades,” said Italian Premier Mario Draghi in parliament on Friday. Italy imports around 45% of its gas from Russia, up from 27% a decade ago.

Because of Europe’s reliance on Russian gas, U.S. officials went out of their way to say that they are not seeking to block Russia’s energy shipments despite it being a mainstay of Russia’s budget and thus a chief source of funding for the Russian military attacking Ukraine.

Instability in other markets

Sanctions against Russia could also upend commodity markets for metals, and even food. Ukraine, known as the “breadbasket of Europe,” is a major exporter of wheat. It’s also a major exporter of nitrogen fertilizer used by U.S. farmers. And Agriculture Secretary Tom Vilsack warned fertilizer companies and other farm suppliers against taking “unfair advantage” of the Ukraine conflict by price-gouging.

Fertilizers are in focus because higher costs of production for farmers have contributed to rising food prices. Some heavy users of gas have shuttered or throttled back production, such as producers of fertilizer, which has become more expensive in turn.

Here’s a rundown of major Russian and Ukrainian exports — many of which could affect the global auto industry.

Grains, oilseeds

Russia and Ukraine are major wheat suppliers, accounting for a combined 29% of global exports, the bulk of which go through ports in the Black Sea.

Much of that wheat is exported to major buyers in the Middle East and North Africa such as Egypt and Turkey.

Ukraine is also one of the world’s top four corn (maize) exporters and had been shipping around 4.5 million tons a month with major customers including China and the European Union.

The two countries also account for about 80% of global exports of sunflower oil.

Gas, energy

Europe relies on Russia for around 40% of its natural gas. Most comes through pipelines including Yamal-Europe, which crosses Belarus and Poland to Germany, and Nord Stream 1, which goes directly to Germany. By last year Ukraine was a transit corridor largely for gas going into Slovakia, from where it continued to Austria and Italy.

Russia has said it will continue to deliver uninterrupted natural gas supplies to world markets.

Although EU or U.S. sanctions on Russian gas imports are seen as unlikely, damage to pipelines or Russia stopping gas transit through Ukraine could happen, analysts said, and fully replacing Russian gas to the EU would not be achievable in the short term.

Aluminum

Most Russian metal producers have so far escaped sanctions imposed by the West since Moscow annexed Crimea in 2014.

An exception is the world’s largest aluminum producer outside China, Rusal, which is subject to measures imposed by the United States between April 2018 and early 2019.

Rusal produced 3.8 million tons of aluminum in 2021, about 6% of the estimated world production.

Europe, Asia and North America are Rusal’s main markets. Miner and commodity trader Glencore has a long-term deal running until 2025 to buy primary aluminum from Rusal.

Cobalt

Data from the U.S. Geological Survey (USGS) shows Russia produced 7,600 tons of cobalt last year, more than 4% of the global total.

Russia was the second largest producer, far behind the Democratic Republic of Congo, which produced 120,000 tons.

Nornickel is the largest producer in Russia, selling 5,000 tons in 2021. Nornickel sells most of its output to Europe.

Copper

Russia produced 920,000 tons of refined copper last year, about 3.5% of the world total, according to USGS, of which Nornickel produced 406,841 tons.

Nickel

Nornickel is the world’s top producer of refined nickel. It produced 193,006 tons in 2021 or about 7% of global mine production estimated at 2.7 million tons. It sells to global industrial consumers under long-term contracts.

Palladium and platinum

Nornickel is also the world’s largest producer of palladium and a major producer of platinum.

It produced 2.6 million troy ounces of palladium last year or 40% of global mine production and 641,000 ounces of platinum or about 10% of total mine production.

Gold

Russia is the world’s third largest producer of gold after Australia and China and accounts for about 10% of global mine production, which according to the World Gold Council totaled 3,500 tons last year.

Titanium

Russia’s VSMPO-Avisma supplies titanium to Boeing and Airbus.

Data from USGS shows Russia produced 27,000 tons of titanium sponge and Ukraine 5,400 tons last year. Combined they account for about 15% of the global total.

Steel

Russia produced 76 million tonnes of steel or nearly 4% of the global total, according to the World Steel Association. Half of exports go to Europe.

Diamonds

State-controlled Alrosa, the world’s largest producer of rough diamonds by volume, produced 32.4 million carats in 2021, about 30% of the global total.

Fertilizers

Russia is a major producer of potash-, phosphate- and nitrogen-containing fertilizers — crop and soil nutrients. It produces more than 50 million tons a year, 13% of the global total.

Includes Bloomberg, AP and Reuters content.

Source: www.autoblog.com