Russia’s ultra-wealthy oligarchs have lost $32bn (£23.5bn) so far this year, and looming sanctions mean even more of their wealth could be wiped out.

The country’s 23 billionaires currently have a net worth of $343bn, according to Bloomberg rankings. That’s down from $375bn at the end of the year.

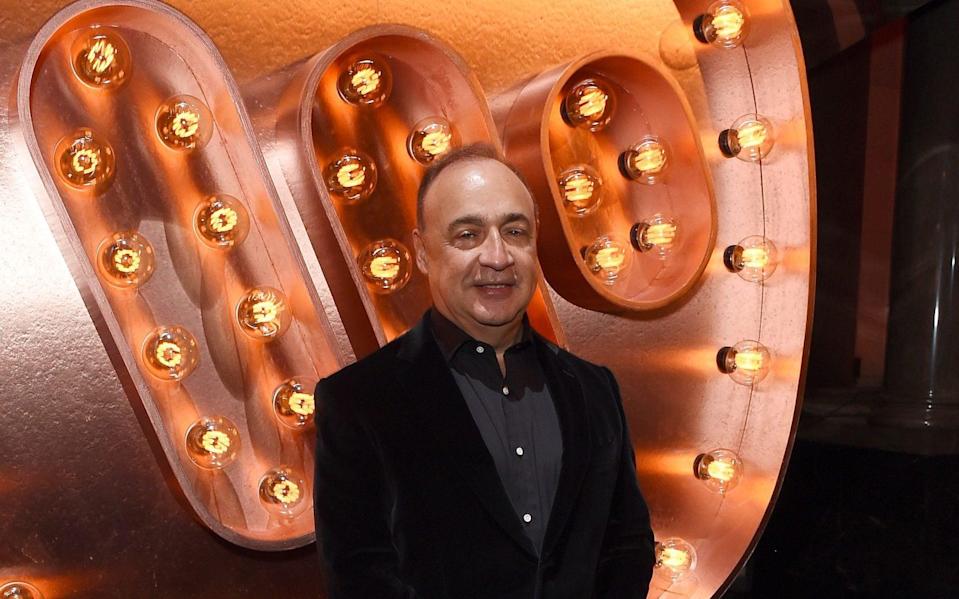

Gennady Timchenko, an oligarch with family ties to Putin, has been the biggest loser from the crisis, with a third of his wealth wiped out this year.

He’s one of three individuals – alongside Boris and Igor Rotenberg – singled out for UK sanctions. The US is also targeting wealthy Russians, meaning their losses could mount.

Earlier today Foreign Secretary Liz Truss refused to rule out sanctions against Roman Abramovich, the billionaire owner of Chelsea Football Club.

06:08 PM

Wrapping up

It’s time to wrap up the blog, thank you for sticking with us today! Before you go, check out the latest stories from our business reporters:

06:07 PM

Zuckerberg unveils work to improve how humans chat to AI

Facebook owner Meta is working on AI research to allow people to have more natural conversations with voice assistants, chief Mark Zuckerberg said at the company’s live-streamed artificial intelligence event.

It would mark a step towards how people will communicate with AI in the metaverse. Meta’s Project CAIRaoke is “a fully end-to-end neural model for building on-device assistants,” said Zuckerberg.

The tech behemoth is betting that the metaverse, a futuristic idea of virtual environments where users can work, socialise and play, will be the successor to the mobile internet.

The social media company, which recently lost a third of its market value after a dismal financial report, has invested heavily in its new focus on building the metaverse and changed its name to reflect this ambition.

Bringing your imagination to life is easier when you have some help

BuilderBot enables people to generate or import things into a virtual world just by using voice commands. pic.twitter.com/Y38vpAWi4Q

— Meta (@Meta) February 23, 2022

05:47 PM

Begbies Traynor forecasts rise in company failures

Restructuring specialists Begbies Traynor said company administrations are set to rise this year due to wider economic pressures and when the final Covid support measures come to an end.

The group noted administrations still remain “much lower” than pre-pandemic levels, but it should benefit from a return to more normal numbers in its new financial year.

Executive chairman Ric Traynor said: “Although insolvency numbers are inexorably rising, the market is still awaiting a rise in the larger and more complex instructions that may result from the current economic headwinds and the removal of the final Government financial support measures in March.”

Results for the year to the end of April are set to be in line with expectations and “significantly” ahead of the previous year.

05:31 PM

Maternity brand worn by Duchess of Cambridge issues profit warning

A maternity fashion brand worn by the Duchess of Cambridge has warned about a slowdown in sales after a plunge in births during the pandemic. Laura Onita reports:

Seraphine, which has stores in London, Leeds, New York and Paris, blamed the reduced appetite for its wares on the cold weather in recent weeks.

It follows official figures that revealed births dropped to a record low of 681,560 as the pandemic gripped the country. The number of deaths was the highest in over a century in 2020, according to the most recent data available.

Meanwhile, the fertility rate in the UK plunged to a record low of 1.6 per woman in 2020 amid unprecedented uncertainty for families. Seraphine said its sales were not affected by the baby bust phenomenon.

05:14 PM

FTSE 100 flat as a pancake

The FTSE 100 has ended the day flat as investors await Russia’s next move after Western sanctions were imposed on Moscow for ordering troops into separatist regions of eastern Ukraine.

The blue-chip index closed at 7,498, with Barclays up 3.1pc after its annual profit nearly trebled as bad loan charges plunged and its investment bank continued its strong recent performance.

“Barclays is showing signs of a story that keeps getting repeated through the financial sector. The impact of the pandemic on the sector isn’t as severe as first feared,” said Susannah Streeter, senior investment analyst, Hargreaves Lansdown.

04:56 PM

Saudi Aramco completes natural gas pipelines deal led by BlackRock

Saudi Aramco has closed a deal to sell a stake in its natural gas pipelines for $15.5bn (£11.4bn) and signed an agreement with BlackRock to explore low carbon energy projects.

An investor group, led by BlackRock, acquired a 49pc stake in Aramco Gas Pipelines in a lease and leaseback deal in December. The consortium also comprised Keppel Infrastructure Trust, Silk Road Fund, China Merchants Capital, and Saudi Arabia’s state-owned Hassana Investment.

BlackRock’s investment comes even as chief Larry Fink puts pressure on firms to boost environmental, social and governance, or ESG, standards. Gas is a cleaner fuel than crude oil but still contributes to heating the planet.

Fink said: “Getting to a net zero world will not happen overnight.

“It requires us to shift the energy mix in incremental steps to achieve a green energy future. Bold, forward-thinking incumbents like Aramco have the technical expertise and capital to play a crucial role in this transformation.”

04:37 PM

Vauxhall Corsa fuels profits at car maker Stellantis

Vauxhall owner Stellantis tripled its profits last year, aided by the enduring sales of its best-selling Corsa in the UK. Howard Mustoe writes:

The £16,500 car topped the sales chart in the UK in 2021 with 41,000 units being driven off forecourts, beating the Tesla Model 3 by more than 6,000 sales. It also topped the sales chart in Germany under the Opel brand.

Stellantis posted a net profit of €13.4bn after sales rose 14pc to €152bn. It was also helped by sales of its upmarket DS Automobiles brand and was able to demand more for its Dodge-branded muscle cars such as the Challenger and Charger.

Stellantis is a product of the merger last year of PSA and its Citroen, Peugeot, Vauxhall and Opel brands, with Fiat-Chrysler, which also owned Dodge, Ram, Lancia, Maserati and Alfa Romeo marques, creating an automaker worth €55bn.

04:17 PM

Clifford Chance lawyer proposes ‘chief happiness officer’ role in race for managing partner

A lawyer at ‘magic circle’ firm Clifford Chance has proposed to create the role of ‘chief happiness officer’ as part of his manifesto in the race to the managing partner position.

Tech co-head Jonathan Kewley wants to make sure staff enjoy “the most vibrant, happy and uplifting place to work in the world” and get perks such as “micro-retreats every six weeks”, “sponsorship for passion projects and hobbies” and trial a four-day working week.

He is facing competition from colleague Michael Bates, the only other candidate for the top role, who has submitted a more traditional proposal.

04:08 PM

Handing over

That’s all from me – thanks for following along! Handing over now to Giulia Bottaro.

04:07 PM

Britain’s richest man bankrolls $3.7bn losses for Dazn

An attempt by Britain’s richest man, Sir Leonard Blavatnik, to conquer the sports TV market has racked up another year of heavy losses to reach an accumulated deficit of more than $3.7bn (£2.7bn).

James Titcomb has more:

In delayed accounts filed at Companies House, the streaming operator Dazn reported a pre-tax loss of $1.3bn for 2020 as the pandemic tore up sporting schedules around the world.

The figure would have been significantly worse had the company not been able to reduce its broadcasting rights bill by more than $500m in robust negotiations with sporting bodies.

In one dispute, Dazn is seeking $19.7m through the courts from the rights agency IMG, which has filed a counterclaim seeking $11.6m.

Mostly as a result of the smaller rights bill, Dazn’s losses were down on 2019’s figure of $2bn.

The venture, dubbed the “Netflix of sport” has accumulated billions in losses over six years, almost entirely funded by Sir Leonard.

03:48 PM

… and oil rises again

Like clockwork, just as rising tensions took the shine off equities, oil prices pushed higher again.

Benchmark Brent crude pushed back above $98 a barrel while West Texas Intermediate gained as much as 2.2pc as worries about the Ukraine situation intensified.

It came as Ukraine said several of its government and bank websites were down after being hit by a cyber attack. Last week, the country suffered its worst distributed denial-of-service (DDoS) attack in history.

Oil prices have been volatile this week as traders track every development in the crisis, as well as progress in talks over an Iran nuclear deal.

However, analysts are still expecting oil to break the $100 mark, with prices forecast to rise as high as $140 if a full-scale conflict breaks out.

03:39 PM

FTSE 100 falls back as Ukraine worries linger

Markets are continuing their rollercoaster ride this week, with stocks going into reverse amid renewed worries about tensions in Ukraine.

Shares had risen earlier in the day after initial sanctions against Russia were less severe than feared, but that optimism seems to be running out of steam.

The FTSE 100 erased its gains for the day to trade only marginally higher. Barclays is still the biggest gainer on the blue-chip index, while Evraz has dropped more than 10pc on sanction worries.

The jitters are being felt elsewhere, too. The pan-European Stoxx 600 index dipped 0.2pc, while Wall Street also slid into the red.

The Ukraine crisis has added to a mountain of troubles for stocks, which are already contending with surging inflation and signals of monetary tightening by central banks.

03:28 PM

ECB asks banks to assess Russia risks

The ECB is asking banks in the eurozone to assess their exposure to risk for Russia as the West threatens to ratchet up sanctions over Ukraine.

The central bank told AFP: “The ECB is closely monitoring the situation, and is in close contact with supervised banks and national competent authorities.”

The ECB is said to be looking at what consequences further sanctions or the fallout from a wider invasion of Ukraine could have on banks’ liquidity, loan books and their ability to keep operations running.

Meanwhile, Boris Johnson was due to attend a meeting today with banks and regulators to discuss sanctions.

03:20 PM

Andrew Bailey: Companies must hold down prices to curb inflation

Andrew Bailey has told companies to hold down prices to help Britain battle inflation, as the Bank of England Governor faced criticism for previously telling workers to show “restraint” when asking for pay rises.

Tim Wallace has more:

Inflation from soaring energy prices risks becoming more embedded in the economy if companies demand higher prices and workers seek higher wages to compensate, he said, which would in turn risk higher interest rates and slower GDP growth.

“It is not just wage-setting, it is also price-setting. It is also company margins. I want to make clear that it is both,” Mr Bailey said, calling for “thought and restraint”.

“It is quite understandable that the wage and price-setting process will seek to correct for the very big external shock we have had, and the shock we have had to national income – it is effectively like a tax on the UK from the outside.”

The danger, he said, was in setting off a chain of inflation in the UK, causing further pain.

03:08 PM

Ukraine hit by fresh cyber attack

Several Ukrainian government websites including those of the Cabinet of Ministers and the parliament have been hit by cyber attacks, according to news agency Interfax.

The web pages of ministries including the Foreign Ministry and the Defence Ministry are either temporarily out of order or are not operating smoothly.

Ukraine has suffered a string of cyber attacks in recent weeks as President Putin puts Russia on a war footing against its neighbour.

The National Cyber Security Centre – part of GCHQ – has urged British organisations to step up their cyber defences, warning attacks could have international consequences.

02:43 PM

Evraz tumbles amid oligarch crackdown

Shares in Evraz have slumped to the bottom of the FTSE 100 as the UK and US roll out sanctions against Russian oligarchs.

The mining firm, whose largest shareholder is Chelsea FC owner Roman Abramovich, tumbled 7.5pc. It had risen yesterday after an initial wave of UK sanctions weren’t as severe as feared.

Boris Johnson and Joe Biden have both targeted a handful of ultra-wealthy Russian individuals as part of the measures against Moscow.

Mr Abramovich has not been implicated in the sanctions so far, contrary to a statement by the Prime Minister in the Commons yesterday. However, Foreign Secretary Liz Truss refused to rule out future measures against him.

Evraz is also coming under pressure ahead of a reshuffle of London indices next month. Analysts have tipped easyJet to replace the miner in the FTSE 100.

02:33 PM

Wall Street opens higher after modest Russia sanctions

US stocks pushed higher at the opening bell after Western nations rolled out a modest set of initial sanctions against Russia.

The S&P 500 and Dow Jones opened 0.5pc and 0.3pc higher respectively, while the Nasdaq jumped 1pc.

02:14 PM

Oil fluctuates as traders weigh sanctions

Oil is swinging between gains and losses today as traders weigh up the impact of the first raft of sanctions against Russia.

Brent crude is trading at around $97 a barrel after jumping to just shy of $100 on Tuesday as Ukraine tensions escalated.

The UK and US have unveiled sanctions targeting Russian banks, its sale of sovereign debt and a handful of wealthy individuals, but they’ve stopped short of a sweeping package of penalties.

Analysts expect oil to breach the $100 milestone, with prices jumping as high as $140 if there’s a full-blown conflict in Europe.

Markets also have an eye on talks to revive the Iran nuclear deal. Any success would open the door to a lifting of US sanctions, and therefore higher oil supplies.

02:01 PM

Mini factory shuts down production amid chip shortage

Mini has shut down production at its factory in Oxford due to a global shortage of semiconductors that’s rattling the industry.

BMW Group, which owns the iconic British car brand, said the Cowley factory shut down on Monday and would remain closed for the rest of the week.

It added: “We are monitoring the situation very closely and are in constant communication with our associates and suppliers.”

Production at the factory was suspended for three days in April and May last year due to the same issue.

01:45 PM

UK to host meeting of banks over Russia sanctions

The Government will host a meeting of banks, regulators and trade associations today to discuss sanctions against Russia.

Economic Secretary to the Treasury John Glen will chair the meeting, with attendees expected to include Lloyds, Credit Suisse, Barclays and NatWest. Boris Johnson is also set to attend.

The Prime Minister’s spokesman said ministers will discuss the approach to sanctions and “listen to their views on ways in which Russian access to UK financial services can be further limited beyond the sanctions that we have set out”.

12:51 PM

Ofcom fires warning shot at Russia Today over impartiality

Ofcom will sharpen its focus on Russia Today amid mounting political pressure to ban the Kremlin-funded news broadcaster in retaliation to Vladimir Putin’s invasion of Ukraine, writes Ben Woods.

Complaints about RT would be prioritised, the media regulator said, as Liz Truss, the Foreign Secretary, branded the news network a purveyor of “propaganda and fake news” and urged the watchdog to step up its scrutiny.

The British arm of RT is based in London and broadcasts news and current affairs with a pro-Kremlin stance on respective Freeview and Sky channels 113 and 511.

Concerns about the broadcaster have intensified in recent days, as MPs called for a tougher response from Boris Johnson to the Russian president’s decision to back the territorial claims of pro-Russian separatists over the Ukrainian regions of Donetsk and Luhansk.

The Labour leader Keir Starmer told the House of Commons on Tuesday that RT should be banned to curtail a “campaign of misinformation” from the free-to-air channel.

12:40 PM

Barclays boss took pay cut after replacing Jes Staley

Most of the time, a promotion means a pay rise. But when CS Venkatakrishnan took the top job at Barclays, he actually took a pay cut.

The bank’s former head of global markets was handed a £2.7m salary when he was abruptly catapulted to the job of chief executive in November following Jes Staley’s departure over his links to sex offender Jeffery Epstein.

In its annual report today, Barclays revealed that’s less than what Venkatakrishnan – known as Venkat – was earning in his previous role.

The bank said his pay was an “appropriate starting point” and more than Mr Staley’s, but added it was low compared to international banking rivals.

Venkat’s fixed pay for 2022 will be £2.78m. When various bonuses and benefits are added, he could earn as much as £9.4bn, Bloomberg reports.

12:26 PM

Heathrow plots revival of third runway as passengers return to the skies

The pandemic has strengthened the case for Heathrow’s third runway, Britain’s biggest airport has claimed, despite passenger numbers falling to the lowest level in half a century.

Oliver Gill has more:

Heathrow handled just 19.4m passengers last year, the fewest since 1972, after a stop-start year blighted by Covid-related travel restrictions.

Cost-cutting helped reduce losses by more than a tenth to £1.8bn, however.

In a move that will anger opponents of expansion, the airport said the crisis had shown “pent-up demand from airlines to fly from Heathrow”.

The chief executive, John Holland-Kaye, said: “While 2021 was the worst year in Heathrow’s history … demand is now starting to recover and we are working closely with airlines to scale up our operations.”

12:21 PM

Wall Street set to rise as markets shrug off sanctions

US stocks are poised to open higher this afternoon as investors assess an initial raft of sanctions against Russia over Ukraine.

Futures tracking the S&P 500 and Dow Jones both rose 0.8pc, while the Nasdaq pushed 1pc higher.

US President Joe Biden said Russia had started to invade Ukraine and announced steps targeting Russia’s sale of sovereign debt abroad, its elites and a pair of banks.

It follows similar moves by the UK and other allies. They stopped short of sweeping measures, though Boris Johnson said sanctions could be scaled up.

12:12 PM

The £100m Gatsby mansion offering luxury in the Cotswolds

ICYMI – Plans have been unveiled for a £100m mansion in the rolling Cotswolds countryside that would be the largest home built in Britain for a century.

Helen Cahill has dug into the details of the eyebrow-raising estate, which promises a taste of the Gatsby lifestyle (for better of for worse) to Britain’s billionaire set.

The £100m Cotswolds mansion plans offering a ‘Gatsby’ lifestyle to the billionaire set

12:02 PM

Bailey: Russia sanctions pose no risk to UK finance sector

One more quick note on Andrew Bailey’s appearance this morning, which has left investors largely unmoved.

He reassured MPs that sanctions against Russia posed no threat the UK’s financial stability, as British banks had very limited exposure to Russia.

Mr Bailey also said wider concerns that tougher action on Russia might hurt London’s position as a global financial hub were also misplaced.

He said: “The situation is so serious… I don’t think that saying ‘well this could be a bit damaging to London as a financial centre’ is just really an argument that holds water.”

11:53 AM

Pound holds gains after Bank of England speeches

Sterling has held onto its gains against the dollar after Andrew Bailey and other Bank of England officials tried to cool down bets on aggressive interest rate rises.

Speaking about the decision earlier this month to raise interest rates, Bailey said he saw clear risk of inflation sticking at a high level. But he urged investors not to get carried away with bets on future interest rate hikes.

He told MPs: “If we get the second-round effects… of course we would need to react to that with higher interest rates.” However, he said this would hurt the economy and increase unemployment.

The pound barely moved after the comments. It stayed up 0.1pc against the dollar at $1.3601 and was flat against the euro at 83.35p.

11:42 AM

IMF urges Bank of England to sell £650bn of bonds

Earlier today Andrew Bailey said officials hadn’t decided exactly how much of Bank’s £895bn bond programme should be paid down. Well, the IMF has a suggestion.

In a report today, the group said the central bank should sell around £650bn of Government bonds to reduce its balance sheet by two-thirds in a return to normal policy after 13 years of quantitative easing.

However, the IMF took aim at the Bank’s lack of clarity over when it would kick off bond sales. It said changes to the size of the BoE’s balance sheet could cause “volatility in government bond and other asset markets”, urging it to “clarify communications”.

Still, it welcomed the decision to raise interest rates, echoing predictions that inflation will top 7pc.

11:32 AM

Barclays boss: Our exposure to Ukraine is ‘limited’

The chief executive of Barclays has insisted that rising tensions between Russia and Ukraine would have only a limited impact on the bank.

CS Venkatakrishnan, known as Venkat, told reporters: “From a financial point of view, our exposures are limited. We have been out of Russia for many, many years and we have exercised a lot of care and diligence on on-boarding Russian entities and Russian clients.”

So far, the UK has rolled out sanctions on five Russian banks and three wealthy individuals. The US has also targeted a pair of state-owned Russian banks and three oligarchs.

Venkat said the bank has a “robust and straightforward process for changes in sanctions regime.” He added that the moment sanctions were announced “we took those names, we put them through our system and screened them”.

11:24 AM

TfL to scrap face mask rules

Transport for London (TfL) will no longer require face masks on public transport – but it’s still strongly recommending them.

The transport body said face coverings will no longer be mandatory on Tubes, trains and buses from tomorrow.

TfL said passenger numbers were continuing to recover, with weekday Tube use at around 60pc of pre-pandemic levels. This rose to 75pc last weekend.

11:19 AM

Peel Hunt slumps as delayed deals spark profit warning

Peel Hunt plunged this morning after it warned a slew of delayed deals will dent its investment banking revenue.

Shares in the broker dropped 15pc to a record low after it said concerns about inflation, interest rate hikes and geopolitical tensions had all taken their toll.

A recent slowdown in trading activity is adding to the pain, with the company now expecting full-year profits to be lower than current market expectations.

Still, Peel Hunt said its investment banking division is expected to post record revenue for the year to the end of March.

11:12 AM

Bailey: Wage restraint comments also apply to bank bonuses

Andrew Bailey has said his recent remarks about British workers not asking for a pay rise also apply to bonuses paid to bankers.

Speaking in front of MPs, he said: “We don’t set pay levels in banks. But the same point holds. Please reflect on the economic situation we’re in with this very big shock coming in from outside.”

The Bank Governor sparked a backlash earlier this month after saying employees should limit their pay bargaining to prevent the UK sliding into a wage-price spiral.

But he’s at risk of sparking outrage again. Asked how much he’s paid, Mr Bailey seemed to suggest he’s lost track.

He said: “It’s somewhere over £500,000. I can’t tell you exactly what it was. I don’t carry that around in my head.”

Labour MP Angela Eagle reminded him that his pay including pension is in fact £575,538. That’s around 18 times the average salary.

10:43 AM

Andrew Bailey: Asset sales could be paused during market turmoil

Andrew Bailey has said the Bank of England’s planned asset sales could be suspended if there’s too much volatility in markets.

The central bank is set to run down its £895bn bond purchase programme as part of a wider tightening of monetary policy.

Mr Bailey said it would consider kicking off this process when rates hit 1pc, but that this would only happen during “normal market conditions”.

10:31 AM

GSK seeks approval for Covid-19 vaccine

Better late than never seems to be the policy for GlaxoSmithKline, which is seeking regulatory approval for its Covid-19 vaccine two years into the pandemic.

GSK and French partner Sanofi said they plan to submit data from both their booster and Phase III efficacy trials in an effort to get the jab approved.

Thomas Triomphe, executive vice president for Sanofi Vaccine, said: “We’re very pleased with these data, which confirm our strong science and the benefits of our Covid-19 vaccine. The Sanofi-GSK vaccine demonstrates a universal ability to boost all platforms and across all ages.”

Unlike rivals including Pfizer, AstraZeneca and Moderna, GSK didn’t develop a vaccine for the first waves of the virus.

However, its antibody drug, which was found to cut the chances of hospitalisation and death, was approved in December.

10:23 AM

UK to guarantee up to $500m in loans for Ukraine support

The UK is ready to guarantee up to $500m (£368m) in loans to support Ukraine and help mitigate the economic effects of Russian aggression.

The Foreign Office said guarantees of Multilateral Development Bank lending will be offered for projects that will support economic stability and reforms such as tackling anti-corruption.

Foreign Secretary Liz Truss said:

We are putting our money where our mouth is and using Britain’s economic expertise and strength to support the people of Ukraine.

These guarantees can help inject vital capital into Ukraine and help its economy weather the storm of Russian aggression.

10:11 AM

BoE’s Haskel: Ukraine crisis could drive up inflation

Bank of England policymaker Jonathan Haskel has warned the escalating conflict in Ukraine could add to inflation risks.

Consumer price growth already stands at a 30-year high, but Mr Haskel warned this could surge even higher as looming conflict drives up energy prices.

He told MPs in written testimony: “If certain geopolitical events specifically affect the commodity supply chain, it could create substantial price volatility.

“At the time of writing, there seems a material risk of further increases in global gas prices which would only add to the already considerable rises in CPI inflation we have seen so far.”

10:07 AM

Darktrace rises after first acquisition

Darktrace pushed higher this morning after unveiling a deal to buy Dutch rival Cyberprint for €47.5m (£40m) – its first ever acquisition.

Analysts said the takeover, which will be paid 75pc in cash and 25pc in equity, is “highly complementary” to the firm’s existing business.

Shares in the FTSE 250 company rose 3.5pc.

09:56 AM

Energy bills will rise again next winter, warns Octopus

Households should brace for higher energy bills next winter as the energy price cap is likely to rise again, the boss of Octopus Energy has warned.

Ofgem has already said the price cap will jump 54pc in April, and the next review is due in October.

Speaking to Bloomberg, Greg Jackson said: “Even aside form the Ukraine crisis, gas prices were at record levels driven by the pandemic, supply chain issues and long cold winters and lack of storage, so it’s a perfect storm in the global gas market.”

He added: “It’s likely that winter is going to be more expensive in the UK because of the way the Government price cap formula works. Next winter is when it’s really going to bite unless more measures come in or prices fall rapidly.”

09:49 AM

Pound ticks up with Bank of England officials in focus

Sterling edged up this morning alongside the FTSE, with traders turning their attention to a string of senior Bank of England officials being grilled by MPs.

All eyes are on Governor Andrew Bailey, Deputy Governor Ben Broadbent and other two BoE members for any indications of how the central bank will act at its meeting next month.

Yesterday Deputy Governor Sir Dave Ramsden signalled more monetary tightening, but said he now sees a “modest” interest rate hike over the coming months.

Sterling is also getting a boost from a more aggressive easing of Covid restrictions. Boris Johnson has announced all remaining rules will be scrapped this week, including mandatory isolation after testing positive.

The pound edged 0.1pc higher against the dollar to $1.3607. Against the euro it was flat at 83.41p.

09:36 AM

Ted Baker shares surge as it shrugs off omicron hit

Shares in Ted Baker leapt in early trading as it reported a sharp rise in quarterly sales despite the impact of the omicron variant.

The fashion brand said sales increased 35pc year on year in the 12 weeks to 29 January, up from growth of 18pc in the previous three months. Compared to pre-Covid levels, sales were down 10pc before omicron hit, tumbling to 42pc when the new variant set in.

But Ted Baker issued a bullish outlook for the year ahead, saying it had navigated supply chain issues and confirming its targets. The company has signed a new franchise agreement in the UK, with plans for at least three new stores per year over the next three years.

Analysts at Liberum said the sales growth reflected a revamp in Ted Baker’s brand. Shares surged 12pc.

09:28 AM

Covid fraud could cost £16bn, MPs warn

Fraud and errors relating to the Government’s Covid support schemes could cost British taxpayers as much as £15.7bn.

That’s according to MPs on the Public Accounts Committee, who estimated £5.3bn of the lost cash related to Rishi Sunak’s flagship furlough scheme. That’s 8.7pc of payments made under the programme.

Other loans and grants programmes added to what the committee branded “unacceptable” losses.

The MPs said the Government has spent £261bn on 374 different measures tackling Covid so far. That’s expected to reach £370bn over the lifetime of the measures, with some loan repayments not due for two decades.

They also pointed to other losses, including £21bn of loans that aren’t expected to ever be repaid.

Meg Hillier, chair of the committee, said:

Lack of preparedness and planning, combined with weaknesses in existing systems across government, have led to an unacceptable level of mistakes, waste, loss and openings for fraudsters which will all end up robbing current and future taxpayers of billions of pounds.

09:20 AM

Aston Martin eyes higher shipments on DBX demand

Aston Martin expects deliveries to rise by 8pc this year as booming demand for the DBX SUV helps to offset delays in its Valkyrie supercar.

The luxury car maker reported earnings before interest, tax, depreciation and amortisation of £65.6m in the fourth quarter – falling short of analyst estimates of £81m.

For the year as a whole, pre-tax losses narrowed to £213.8m from £466m in 2020, with revenues jumping 79pc to £1.1bn.

Aston’s profits have been dented by delayed deliveries of the £2.4m Valkyrie, but bosses said they hope to ship between 75 and 90 Valkyries to wealthy customers in 2022.

The company also sold more than 3,000 DBXs last year, giving it a 20pc share of the luxury SUV market.

09:13 AM

Unite Group jumps as student demand bounces back

Unite Group is the biggest riser on the FTSE 250 this morning after it reported a continued recovery in demand after the pandemic.

The student accommodation specialist posted 2.3pc rental growth last year, while occupancy rose to 94pc. It added that demand was growing as university applications for the next academic year are 7pc higher than pre-Covid levels.

Shares jumped as much as 9.3pc – the biggest rise since November 2020 – before easing to gains of 7.5pc.

09:01 AM

Heathrow records lowest passenger numbers for 50 years

Heathrow Airport’s losses from two years of Covid disruption have swelled to £3.8bn after it attracted the lowest number of passengers for 50 years.

The London travel hub posted a loss of £1.8bn last year as passenger numbers slumped to 19.4m – the lowest since 1972.

While there was some easing in travel last year, Heathrow’s reliance on long-haul travel meant it suffered a further reduction in traffic.

Demand is on the up, but the omicron variant dented the recovery at the start of the year, leaving passenger numbers 23pc behind its forecasts.

Heathrow said a strong summer season should push full-year passenger numbers to its target of 45.4m, but it’s also relying on approval from the Civil Aviation Authority to raise the fees it charges to airlines.

08:58 AM

Expert reaction: Barclays shows potential after profit beat

Will Howlett, an analyst at Quilter Cheviot, says Barclays’ latest figures show it’s an attractive proposition for shareholders.

Barclays delivered a broad based profit beat for the final quarter of 2021, which we would expect to support earnings upgrades.

The bank is announcing a further £1bn share buyback, which should been seen as particularly which we see as particularly attractive with the shares trading at a significant discount to tangible book value.

Barclays has reiterated its target of delivering a return on tangible equity of greater than 10pc, and after delivering 13.4pc in the financial year 2021, albeit flattered by net provision writebacks, the shares offer significant potential for re-rating, in our view.

08:55 AM

FTSE risers and fallers

The FTSE 100 has started on the front foot today as strong corporate earnings and positive sentiment among miners lifted sentiment.

The blue-chip index rose 0.6pc, building on yesterday’s gains as markets shrugged off sanctions against Russia.

Barclays rose 3.2pc after posting a record annual profit thanks to a boom in pandemic dealmaking.

Rio Tinto was also up 1.2pc after paying out a record dividend on the back of strong results. This helped boost other miners including Antofagasta and Glencore as commodities prices rose amid Russia tensions.

The FTSE 250 rose 0.7pc, snapping a five-day losing streak. Unite Group jumped 7.7pc after strong earnings.

08:29 AM

How the crisis could impact energy bills

ICYMI – here’s what the Russia-Ukraine crisis could mean for your energy bills:

Households are threatened with even higher energy bills including petrol at £1.70 a litre, after the invasion of Ukraine intensified the inflationary forces advancing on global markets.

The incursion by Vladimir Putin’s forces prompted a senior Bank of England official to warn on Tuesday that “moderate” interest rate rises may be required soon – heralding higher mortgage costs – to bring prices under control.

UK and European gas prices climbed 9pc and 10pc respectively after Germany halted the approval process for the Nord Stream 2 gas pipeline, which is being built to deliver supplies from fields controlled by the Kremlin.

Britain is much less directly reliant on Russian gas than continental Europe but is affected by higher prices in the global wholesale market.

Its latest upswing left prices at roughly four times the long-term average and increased expectations of a further increase in the cap on household energy bills at the next review in October.

Read more: Ukraine invasion threatens to push energy bills even higher

08:17 AM

Metro Bank crashes to £245m loss amid regulator fines

While most British banks have emerged from the pandemic with huge profits, the picture isn’t so rosy for Metro Bank.

The high street lender crashed to a £245.1m loss last year as it put aside cash to cover fines from regulators.

An investigation remains ongoing by the Financial Conduct Authority, alongside costs as part of a restructuring and a £5.4m fine by the Bank of England related to its reporting and governance failures.

The figures were an improvement on the £311.4m loss, however. Bosses said they have put in place cost-cutting measures and remain on track to reach a breakeven position. Shares rose 0.8pc.

Daniel Frumkin, chief executive of Metro Bank, said:

Two years into the turnaround, our strategy is delivering meaningful results as we move towards profitability.

In a changing macro-economic environment, we have accelerated the shift of our balance sheet, with improved yields and lower cost of deposits.

There is still more to do but our focus on delivering higher margins through unsecured and specialist mortgage lending, as well as tight cost control, is enabling transformational change.

08:05 AM

Truss: Ofcom should investigate ‘propaganda’ channel Russia Today

A bit more from Liz Truss now.

The Foreign Secretary has said she thinks media regulator Ofcom should investigate Russia’s state-backed news channel Russia Today, which is broadcast in Britain.

She told Times Radio: “On the subject of Russia Today I am of the view that it broadcasts propaganda and fake news on a regular basis and is effectively an arm of the Russian state, and I’m sure Ofcom is looking at that.”

08:02 AM

FTSE 100 inches higher

The FTSE 100 has inched higher at the open as investors weigh up the latest development in escalating tensions between Russia and the West.

The blue-chip index edged up marginally to 7,496 points.

It follows a tumultuous day on Tuesday, when markets initially crashed on Putin’s move into Ukraine before recovering later in the day.

07:59 AM

UK to block Russian sovereign debt from London markets

Britain will stop Russia selling sovereign debt in London after President Vladimir Putin pushed troops into Ukraine.

Foreign Secretary Liz Truss confirmed that the Russian state will not be able to tap UK markets to help raise cash.

She told Sky: “We’ve been very clear that we’re going to limit Russian access to British markets. We’re going to stop the Russian government with raising sovereign debt in the United Kingdom.

“There will be even more tough sanctions on key oligarchs, on key organisations in Russia, limiting Russia’s access to the financial markets, if there is a full scale invasion of Ukraine.”

Boris Johnson yesterday outlined the first tranche of sanctions against Russia, targeting five banks and three high-wealth individuals, but the Prime Minister is facing criticism that the measures don’t go far enough.

07:52 AM

Rio Tinto dishes out record dividend as profits soar

Barclays isn’t the only blue-chip firm posting record results this morning.

Miner Rio Tinto has revealed it pulled in record profits of $21.4bn (£15.7bn) in 2021 thanks to surging iron ore prices and strong demand from China.

Profits were up 72pc on 2020, reaching the highest levels in the firm’s 149-year history, as iron ore earnings roughly doubled.

Jakob Stausholm, chief executive of Rio Tinto, cited “significant price strength for our major commodities,” as he announced a record final dividend of $7.7bn.

It comes as the miner tries to overhaul its culture after a damning report revealed shocking levels of racism, harassment and sexual assault claims at the company.

07:42 AM

New boss hails ‘resilient’ performance

The positive numbers will come as a relief to chief executive CS Venkatakrishnan – known as Venkat – who was thrown into the top job in November following the shock resignation of Jes Staley.

He said:

2021 is the year in which Barclays demonstrated the results of the strategy we set out in 2016.

I am proud that we have delivered this resilient performance while continuing to support our clients and customers through another year of Covid-19 related challenges.

We recognise that the economic environment is more than usually uncertain, with rising inflation rates and tighter monetary policy, while many parts of society continue to recover from the severe social and economic effects of the Covid-19 pandemic.

07:39 AM

Barclays taps first female finance chief

The bank also announced its first female finance chief, appointing deputy group finance director Anna Cross to the role from April 23.

She will succeed Tushar Morzaria, who is retiring after more than eight years in the post, and becomes the first woman to hold one of the top three boardroom jobs at the bank.

07:37 AM

Barclays pulls in record profit amid dealmaking boom

Barclays will be hoping the scandal surrounding Jes Staley doesn’t overshadow a stellar set of results…

A busy final quarter of dealmaking helped offset a decline in trading activity, propelling the British lender to its highest ever annual profit.

Income from capital markets and merger advisory work rose by more than a quarter in the final three months of the year, taking these banking fees to £3.7bn for the year as a whole – the highest since at least 2014.

Profit before tax for the quarter jumped to £1.47bn, more than double last year, as the bank recovered charges from potential bad loans earlier in the pandemic. Annual pre-tax profit hit a record £8.4bn.

Barclays also announced a £1bn share buyback programme and a dividend of 6p per share for 2021 as it shared the spoils with investors. It issues a positive outlook for the coming quarters, with impairments expected to remain below pre-Covid levels.

07:27 AM

Barclays freezes Jes Staley payout

Good morning.

Barclays has revealed it’s suspending the payment of share awards to its former boss Jes Staley amid ongoing investigations into his relationship with the late sex offender Jeffery Epstein.

Mr Staley, who stepped down from the FTSE 100 bank in November, was being treated as a “good leaver”.

At the time, it was announced that he would pocket an annual payout of £2.4m in cash and shares plus a £120,000 pension allowance and other benefits.

He owns 5.7m shares worth around £10m and was also entitled to as many as 11.4m shares valued at £22.5m if the bank hits targets in coming years. The frozen awards are thought to include a 2019 bonus subject to performance between 2019 and 2021. It was worth up to £3.3m.

Barclays said almost 70pc of Mr Staley’s variable remuneration remains unvested, adding it hadn’t made any further decisions regarding the former boss’ pay.

5 things to start your day

1) Britain has logged out of the EU – now it needs a Brexit tech revolution As the UK strikes out from the EU, MPs say new ideas on data should form the backbone of deregulation

2) Inheritance tax revenues hit record high as Treasury gets extra £700m Rocketing house prices and frozen thresholds have seen more cash handed over in so-called ‘death duties’

3) Information Commissioner calls time on the ‘drag’ of Brussels’ data rules A new era of data regulation could mean an end to ‘cookie’ pop-ups

4) HSBC faces US probe into bankers’ use of WhatsApp for work WhatsApp is not approved for ‘business-sensitive messages’

5) Hargreaves Lansdown shares plunge as pandemic trading boom ends The investment platform’s profits fell as workers returning to the office have less time to trade and invest

What happened overnight

Equities mostly rose on Wednesday and oil prices stabilised as investors tracked developments in Ukraine. In early trade, Hong Kong, Shanghai, Sydney, Seoul, Wellington, Taipei and Jakarta were all in positive territory. Singapore and Manila slipped and Tokyo was closed for a holiday.

Coming up today

-

Corporate: Aston Martin Lagonda, Barclays, Capital & Counties Properties, Hochschild Mining, Rio Tinto, Unite Group (full-year results); Ted Baker (trading update)

-

Economics: Bank of England monetary policy report hearings (UK)

Source: finance.yahoo.com