After the turmoil of the past two years, it’s time to take stock of the state of the markets, of national economies, of the corona pandemic, and of what it all means for investors. It’s a lot to bite off, but banking giant JPMorgan, in a new report, tackles just these issues. It’s far more than we can take on here in detail, but we can look at a summary of important points.

For starters, the corona crisis has proven itself highly unpredictable, but investors are used to it now. Current indications are, we’re looking at a virus that is shifting from a pandemic agent to an endemic disease, part of humanity’s normal ‘viral load,’ that we’ll all just have to get used to. This means it will likely become both more contagious and less virulent, with a diminishing impact over the coming few years.

On a positive note, the world-wide crisis of the past two years has seen households and businesses firm up their balance sheets. Through a combination of government support and lower expenditures, households and businesses managed to exit the worst of the pandemic with cash on hand. This, combined with new innovations from the tech sector and changes in the way we see remote work, bode well for economies going forward. JPM predicts it as the ‘foundation for a far more vibrant economic environment,’ with the promise of faster growth after the sluggish 2010s.

At the center of this growth story, JPM sees several megatrends, including digital transformation, healthcare innovation, and environmental sustainability, as drivers of investment, value, and R&D going forward. In short, these are the areas that investors should focus on.

This is the setup to keep in mind, as we use the TipRanks platform to pull up details on three recent JPM picks – stocks that the firm sees well-positioned to gain in today’s environment.. According to the banking giant, these stocks are poised to push higher over the coming year, starting at 45% and going up from there. Let’s take a look, and check in with the analysts.

Solo Brands, Inc. (DTC)

We’ll start with consumer leisure. Solo Brands is a direct-to-consumer (DTC) retail platform selling four premium outdoor lifestyle brands, the company’s original Solo Stove, and the more recently acquired Our Kayak, ISLE Paddle Boards, and Chubbies apparel. The company markets and sells mainly through e-commerce and digital channels. Solo describes its mission as ‘bringing families together in the outdoors,’ and from mid-2016 to the end of 1H21 the company demonstrated a compound annual growth rate of 132%.

Like many companies have done, Solo went public this year. The company held its IPO on October 28, when it put 12.9 million shares on the market at $17 each. This was the high end of the initial range ($14 to $17), and the sale raised over $219 million in gross proceeds.

The October IPO followed Solo’s September reorganization. The company, which had been called Solo Stove, changed its name to Solo Brands to reflect its expansion – the larger product line and sales opportunities made possible by the new brands in its constellation. Taken together, the reorg and the IPO add up to a forward-looking management.

In his note on the stock, JPM’s 5-star analyst Christopher Horvers notes several reasons for investors to take a bullish stand here, including “(1) strong Solo brand momentum and near-term upside drivers; (2) structural advantages from being 84% direct to consumer; and (3) long-term optionality on platform synergies, product innovation, marketing and supply chain efficiencies, international expansion, acquisitions, and margin forecasts.”

Horvers’ comments back up his Overweight (i.e., a Buy) rating, and his $27 price target implies a one-year upside for the stock of 65%. (To watch Horvers’ track record, click here.)

With 7 reviews on record, including 6 to Buy and 1 to Hold, Solo Brands maintains a Strong Buy consensus rating from the Wall Street analysts. The shares are priced at $16.33 and their $26 average price target indicates room for a 59% run-up from that level. (See Solo’s stock analysis at TipRanks.)

Offerpad Solutions (OPAD)

The digital world has changed everything in retail. You name it, it can be sold online – even real estate. Offerpad is an online real estate platform, connecting buyers and sellers directly, and making it easy to put a home on the market, or to find the right home to buy. Sellers can post photos, including a virtual walkthrough tour of the house, buyers can make offers, and transactions can close, all facilitated online.

Like Solo above, Offerpad has just recently entered the public trading markets. The OPAD ticker started trading on September of this year, after completion of a SPAC merger with Supernova Partners Acquisition Company. The move brought proceeds of $284 million to Offerpad when it was completed, and the company has a market cap of $1.76 billion.

While the shares are down since, the company reported solid results for its first quarterly report as a public company. In Q3, Offerpad showed a 190% yoy increase in revenue, to $540.3 million, a gross profit of $53.1 million, up 169%, and an increase in ‘homes sold’ from 749 in 3Q20 to 1,673 in the current quarter. The company reports fast turnover, with over 99% of its inventory selling in less than 180 days.

This stock drew the attention of JPM’s Dae Lee, who wrote, “…we continue to believe that consumers will appreciate the convenience, transparency, & control that OPAD’s offerings provide.”

Lee elaborated, following investor meetings with the company: “Mgmt highlighted that opportunity is large, the market is highly fragmented, and 99% of real estate transactions are done offline. Currently, sellers who do not accept OPAD’s offer more often are going to traditional brokers than to a competing iBuyer. As such, mgmt believes raising awareness & increasing consumer adoption of iBuying are more important for growth than gaining share from other iBuyers. OPAD’s differentiated offerings, incl. 24hr closing, extended stays, bundling, & ancillary services, among others, should help OPAD gain share from traditional model.”

In line with these comments, Lee rates the stock Overweight (Buy) and gives the stock an $11 price target to suggest a 49% upside for the year ahead. (To watch Lee’s track record, click here.)

Offerpad, in its short time as a public company, has garnered 3 analyst reviews, with a breakdown of 2 Buy to 1 Hold for a Moderate Buy consensus view. The average price target is $11.33, which gives a 53% upside from the trading price of $7.38. (See Offerpad’s stock analysis at TipRanks.)

Bioventus (BVS)

We’ll wrap up with Bioventus, a health care innovator. JPM is generally bullish on innovative health stocks, so it’s not surprising to find BVS here. The company has a line of products for pain treatment, restorative therapies, and surgical solutions – all with the general aim of delaying and simplifying difficult orthopedic surgeries. Products include the Exogen ultrasound bone healing system, Durolane for osteoarthritis pain relief, and several orthobiologic products to make orthopedic surgeries easier and less invasive.

In a move that shows the underlying strength of Bioventus’ business, the company announced last month that it is expanding its manufacturing facilities, moving them to a larger venue in suburban Memphis, Tennessee. The company will move 116 people to the new facility in 2H22, ending 10 years at its current address, and plans to add 40 new positions over the next half-decade. The facility will include 55,000 square feet of light manufacturing space.

In other positive news for the company, Bioventus in October completed its acquisition of Misonix. Misonix is a leading provider of minimally invasive therapeutic ultrasonic technologies, and with this merger, the combined company can look toward a $15 billion total addressable market in regenerative medicine and wound healing.

The company’s upbeat outlook continued with its early-November release of the 3Q21 financial results. Bioventus showed net sales up by $23 million, to a total of $108.9 million. This was a 26% yoy gain. The growth in revenue prompted management to revise its 2021 full-year sales guidance upwards, from the $405 million to $415 million range to a new range of $425 million to $430 million. The new outlook represents a 4.2% increase at the midpoint.

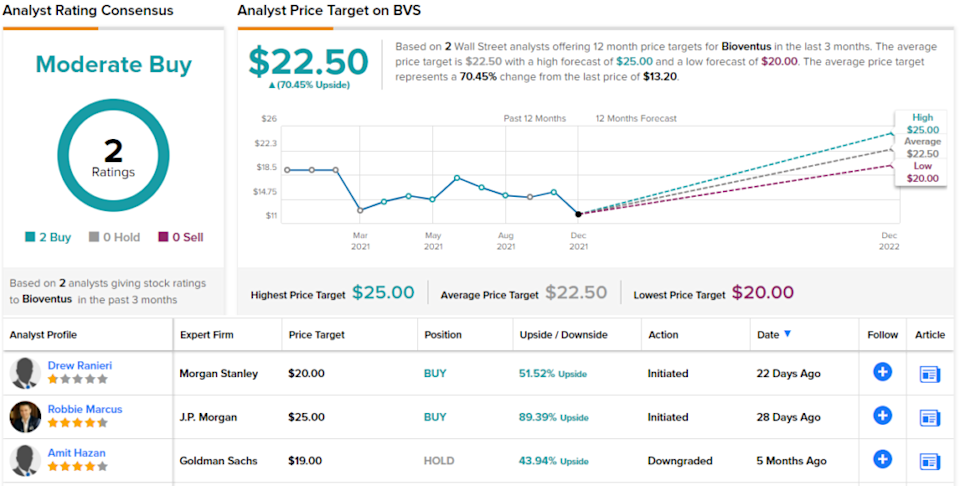

In coverage of Bioventus for JPM, analyst Robbie Marcus sees the company with a solid position, based on its product line and further expansion prospects. He writes, “Exogen is the clear leader in the US long-bone stimulation market and should grow above market as the company benefits from indication expansion for fresh fractures. Lastly, Bioventus’s growing portfolio of hardware-agnostic products allows the company’s orthobiologics products to appeal to a wide variety of physicians, enabling continued share capture. All told, we see this driving a +10% CAGR through 2025, with the potential for upside from new product launches, indication expansion, and continued tuck-in M&A.”

Marcus’ $25 price target, suggesting an 89% one-year upside, goes hand-in-hand with this Overweight (Buy) rating. (To watch Marcus’ track record, click here.)

While there are only 2 reviews here, they both agree that Bioventus is a stock for investors to Buy, giving the shares a Moderate Buy consensus rating. The current trading price is $13.2 and the average price target is $22.50, implying an upside of 70% in the next 12 months. (See Bioventus’ stock analysis at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source: finance.yahoo.com